Oil prices have been a bit volatile of late, sending share prices of Occidental Petroleum (NYSE: OXY) down 25% from their 52-week highs. The stock’s yield is a mediocre 1.7% despite the significant price drop. Most energy stock-focused investors, and particularly income-oriented investors, will be better off with Enterprise Products Partners (NYSE: EPD) and its hefty 7.1% distribution yield. Here’s why.

Occidental Petroleum is a perfectly fine energy company

Most investors have heard the names ExxonMobil and Chevron, which both rank among the largest integrated energy companies on the planet. Integrated energy companies have operations that span from the upstream (energy production) through the midstream (pipelines) and on into the downstream (chemicals and refining). That diversification of operations helps to soften the peaks and valleys inherent to the highly volatile energy sector.

Occidental Petroleum wants to compete with these giants.

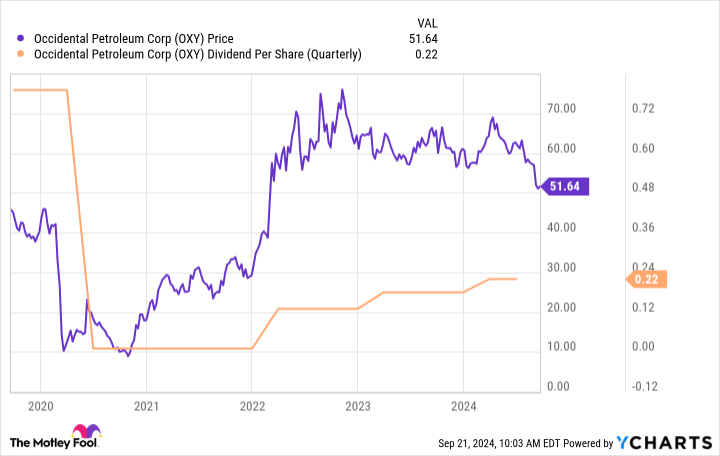

It’s a perfectly fine plan, but it means Oxy, as it is more commonly called, has to grow via acquisition. That’s where the story gets complicated. In 2019, the company bought Anadarko Petroleum, winning a bidding war with Chevron. Warren Buffett’s Berkshire Hathaway even got involved, helping to finance Oxy’s bid. However, the deal was very large, requiring the company to take on material leverage. When oil prices fell during the coronavirus pandemic, Oxy’s dividend ended up getting cut.

The dividend has somewhat recovered, but it is still well below its pre-cut level as Oxy focused on growing its business over rewarding investors with dividends. Notably, it recently inked a deal to buy oil and gas developer CrownRock. It was a smaller deal and should be easier to digest, but it also makes clear that Oxy’s push today is about competing with energy industry giants and not returning cash to shareholders via dividends.

Enterprise Products Partners pays in good times and bad

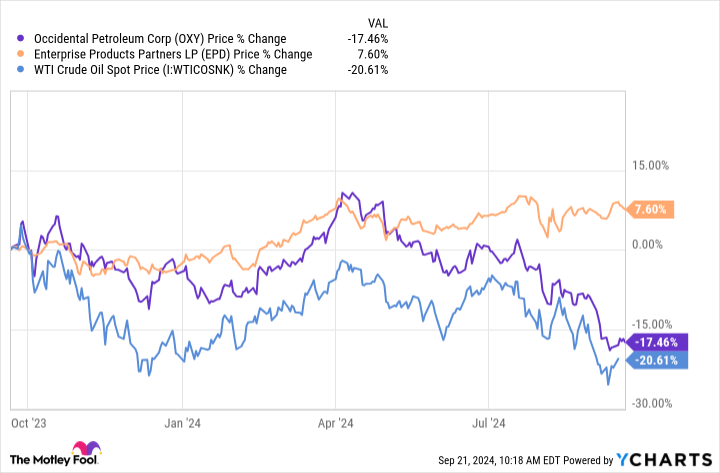

If you are looking for an energy company that is focused on business growth ahead of dividends, Oxy could be a good option. But if you want an energy investment that’s a bit more reliable, then you should look at Enterprise Products Partners and its hefty 7.1% distribution yield. That yield is super important to your total return.

As a master limited partnership (MLP), Enterprise is specifically designed to pass income on to unitholders in a tax-efficient manner. Meanwhile, the business is focused on the midstream segment of the industry, owning energy infrastructure (like pipelines) that produces reliable cash flows. It charges fees for the use of those assets. The price of the commodities flowing through its system aren’t as important as the volume that is flowing through it. Even during periods of low energy prices, demand for energy tends to be robust because of the important economic role oil and natural gas play in the world.

That distribution is strong when you look at financial metrics, as well. For example, Enterprise has an investment-grade-rated balance sheet, and its distribution is covered by distributable cash flow by a safe 1.7 times. The distribution has been increased for 26 consecutive years at this point. The only problem is that growth is likely to be limited in the years ahead, so the big yield will probably make up the lion’s share of return here.

If you are a dividend investor, however, that probably won’t be too big a deal for you. And all it takes is distribution growth of around 3% or so, which is completely reasonable, for the total return profile to approach 10%. That’s roughly what most investors expect from the broader market. And since the highly reliable distribution is going to make up most of your return, this is the kind of energy stock that will let you sleep well at night no matter what is going on with oil prices.

For proof, just look at the graph above comparing the price performance of West Texas Intermediate (WTI) crude, a key U.S. oil benchmark, with the price performance of Oxy and Enterprise. Oxy fell right along with WTI while Enterprise just kept on trucking along. Conservative investors and those looking to live off of their dividends will likely be much better served by owning Enterprise.

Oxy isn’t a bad company, but it is a volatile one

Occidental Petroleum bit off more than it could chew with the Anadarko deal, but it appears to have learned a lesson after being forced to cut its dividend. Still, it is an energy company that is focused on growth in a highly volatile industry. It isn’t for the faint of heart even after a 25% stock price decline. Most investors will probably be happier owning a boring income stock like Enterprise if they want exposure to the energy sector today.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Chevron. The Motley Fool recommends Enterprise Products Partners and Occidental Petroleum. The Motley Fool has a disclosure policy.

Forget Occidental Petroleum — Buy This Magnificent High-Yield Energy Stock Instead was originally published by The Motley Fool