Passive income is a popular concept these days. Defined as money earned outside of a traditional job and requiring minimal time or effort, it is a tantalizing proposition for investors tired of the rat race.

Many people will pitch buying rental properties as the best form of passive income. But I think this is a misnomer. Managing a rental property may be profitable, but it requires a lot of time and effort to maintain. That is not “passive” income in the traditional sense.

The purest form of passive income comes from buying high-dividend-yield stocks, as they require zero upkeep to maintain your cash flow. Here are two ultra-high dividend-yielding stocks to buy with $10,000 over any rental property for your investment portfolio right now.

Legacy tobacco pricing power

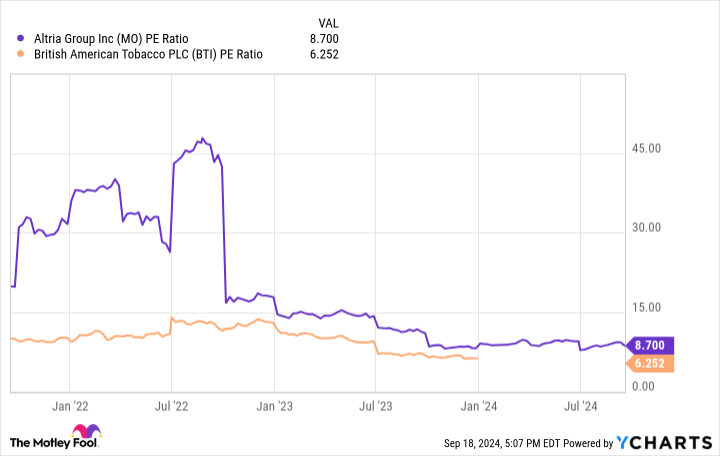

Many investors shy away from investing in tobacco companies. There is an idea that the sector is in terminal decline with fewer and fewer users of cigarettes around the world. While it is true that tobacco consumption is going down, there is still plenty of profit to be made for legacy brands such as Marlboro, owned by Altria Group (NYSE: MO). With so much skepticism pointed toward the industry, you can buy the stock at a cheap earnings multiple today. It currently has a price-to-earnings ratio (P/E) of 8.7.

Today, Altria Group has a dividend that yields 7.83%. If you invest $10,000 into Altria stock, the company will pay out $783 in dividends to you each year. For the last 10 years, Altria has consistently raised its dividend-per-share to stockholders, and the payout has climbed 100% in those 10 years.

The fuel to this dividend growth is the pricing power of its tobacco brands such as Marlboro. Even though cigarette usage — especially in the United States — is falling, Altria has the pricing power to counteract volume declines and grow cash flow (the lifeblood of dividend payments). Free cash flow per share has increased by 125.8% in the last 10 years despite massive declines in cigarette usage in the United States.

Cigarettes may not be around forever. But they will still generate healthy cash flows for many years. This makes Altria Group an easy dividend income stock that will likely generate heaps of passive income and help you grow your wealth without lifting a finger.

MO PE Ratio data by YCharts

International exposure and new-age products

Perhaps a more promising tobacco company is British American Tobacco (NYSE: BTI). It is the owner of legacy cigarette brands such as Newport and sports a higher dividend yield than Altria Group at 8.21%. That equates to $821 in annual passive income on a $10,000 investment.

Even better, British American Tobacco has been much more successful with new-age nicotine products that are stealing market share from cigarettes. These include electronic vaping cigarettes and nicotine pouches. This combined segment reached profitability for the company in 2023 and will be a significant contributor to earnings and cash flow growth in the coming years.

Despite seeing headwinds from foreign currency depreciation, British American Tobacco has grown its free cash flow per share by 35% since 2019. During this period, new-age products were a headwind to profitability as the company scaled up operations. Over the next five years, they are poised to be a tailwind to earnings growth.

As with Altria Group, there is plenty of room for British American Tobacco to keep growing its free cash flow per share over the next 10 years. With a sky-high dividend yield of over 8%, British American Tobacco is a great stock to own to add passive income to your portfolio.

Both of these stocks have dividend yields significantly higher than that of the S&P 500 index, which yields a measly 1.32% today. With the Federal Reserve lowering interest rates, it will be harder to earn a high interest rate with a savings account or Treasury bonds. For those who prioritize passive income, British American Tobacco and Altria Group look like attractive assets to hold in your portfolio right now.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Forget Rental Properties: Invest $10,000 Into These Dividend Growth Stocks With Ultra-High Yields for Passive Income was originally published by The Motley Fool