Since the advent of the internet roughly three decades ago, investors have consistently had a next-big-thing innovation or game-changing technology to captivate their attention. However, 2024 has been somewhat unique in that two trends are vying for recognition at the same time.

While there’s no denying that the rise of artificial intelligence (AI) has helped lift all three major stock indexes to record-closing highs, the excitement surrounding stock splits has played an equally important role in sending the valuations of select prominent businesses higher in 2024.

Think of stock splits as a tool on the proverbial utility belt of publicly traded companies that they can use to adjust their share price. Just keep in mind that this tool is purely cosmetic. Altering a company’s share price and outstanding share count by the same factor has no impact on its market cap or operating performance.

While there are two types of stock splits — forward and reverse — investors overwhelmingly favor forward-stock splits. Forward splits, which are designed to lower a company’s share price to make it more nominally affordable for retail investors without access to fractional-share purchases through their broker, are usually conducted by businesses out-executing their peers.

Since 2024 began, a little over a dozen top-tier companies with sustained competitive advantages have announced or completed a stock split — all but one of which is of the forward-split variety.

Following the close of trading today, the next phenomenal business will step forward and take its place among the “Class of 2024” stock-split stocks, and in the process knock retail juggernaut Walmart (NYSE: WMT) out of the spotlight.

Walmart kicked off stock-split euphoria in late January

Despite tech stocks galore ascending to the heavens on the heels of the AI revolution, it was Walmart that opened the floodgates to major stock-split announcements this year.

In late January, Walmart’s board approved a 3-for-1 forward split — the largest in the company’s history and its 12th split since going public in October 1970 — to make shares more affordable for the company’s employees. Per CEO Doug McMillon, “Sam Walton believed it was important to keep our share price in a range where purchasing whole shares, rather than fractions, was accessible to all of our associates.”

When this split was completed after the close of trading on Feb. 23, Walmart’s share price fell from $175.56 to $58.52, while its outstanding share count increased by a factor of three.

Chief among Walmart’s competitive advantages is its size. Having deep pockets and the ability to buy products in bulk, thereby lowering its per-unit cost for each item, has allowed it to consistently undercut local stores and even regional/national grocery chains on price. Walmart understands the importance of its value proposition with consumers and has consistently won on this front for decades.

Walmart is also enjoying tangible benefits from its e-commerce push. The convenience of prepared pickups and deliveries has hit home with busy consumers, leading to e-commerce sales growth of 22% in the U.S. in the fiscal second quarter (ended July 26, 2024), and 18% in international markets.

But Walmart is yesterday’s news on the stock-split front. A dominant retailer that’s embraced e-commerce, and has seen its shares skyrocket more than 12,000% since its initial public offering (IPO) in 1993, is ready to take center stage for the retail industry.

This skyrocketing retail specialist — up 12,600% since its IPO — is conducting its biggest stock split to date

In mid-July, leading footwear and apparel retailer Deckers Brands (NYSE: DECK) announced plans to conduct a 6-for-1 forward split. This marks only the second time since its IPO that it’s conducting a forward split, with the other being a 3-for-1 split in July 2010.

Former CEO Dave Powers, who retired last month but had led Deckers Brands for the previous eight years, had this to say about his company’s board approving the historic 6-for-1 split:

The trading price of our common stock has risen significantly over the past several years as a result of our strong financial performance and the execution of our strategic plan. We believe effecting the forward stock split will make the shares of our common stock more affordable and attractive to a broader group of potential investors, including our employees, and increase the liquidity of the trading of the shares of our common stock.

The effective date for this split is (drum roll) following the close of trading today, Monday, Sept. 16. When Deckers Brands’ stock opens for trading tomorrow, it’ll be at the split-adjusted price of closer to $156, instead of the $935.07 it closed at on Sept. 13.

As I alluded earlier, one of the longtime keys to Deckers’ success has been its e-commerce push. As of the most-recent quarter, ending June 30, the company reported $310.6 million in direct-to-consumer (DTC) sales, which is up nearly 22% from the prior-year period. More importantly, DTC sales accounted for close to 38% of total revenue, which compares to less than 32% of net sales in the same quarter three years ago.

This almost six-percentage-point improvement might not sound like much, but it’s increasingly made Deckers Brands an inventory-light businesses. Not having to tie up its cash in inventory and manufacturing has led to superior margins for the company.

The strength of the company’s brands has played a key role in its long-term success, as well. Though it owns around a half-dozen major brands, the best-known include Ugg, Hoka, and Teva. Hoka ($420.5 million in the latest quarter), Ugg ($195.5 million), and Teva ($48.4 million) account for the lions’ share of sales.

But the most-exciting aspect of Deckers’ strategy has been its international expansion. E-commerce is still just getting off the ground in international markets, which affords the company a sustained double-digit, high-margin growth opportunity.

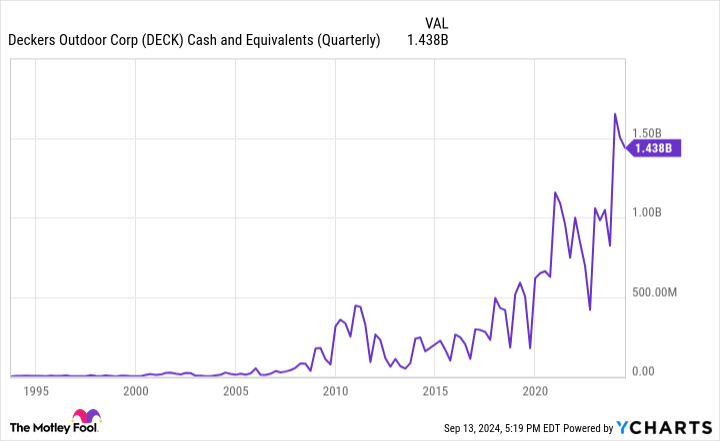

The icing on the cake is that Deckers Brands is a debt-free company with north of $1.4 billion in cash and cash equivalents. It has the financial flexibility to make deals happen, just as it did when it purchased Ugg in 1995 and Hoka in 2012.

While this sizable stock split is long overdue, it can also be argued that Deckers Brands has some work to do to grow into its current valuation. Although the company’s stock is absolutely deserving of a premium given the momentum it’s enjoyed from DTC growth, its international push, and its top-tier branding, shares are trading at 26 times forward-year earnings. This might not seem like a steep price to pay, but consensus annualized earnings growth over the next five years is a more modest 11.4%.

In other words, Deckers Brands will likely need to blow the doors off of Wall Street’s and its own growth forecasts if its stock is to head even higher.

Should you invest $1,000 in Deckers Outdoor right now?

Before you buy stock in Deckers Outdoor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Deckers Outdoor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool has a disclosure policy.

Forget Walmart: The Biggest Retail Stock Split of the Year Has Arrived was originally published by The Motley Fool