Fox Corp. (NASDAQ:FOXA) is known for its diverse portfolio of news, sports and entertainment content. With a strong presence in the U.S. market, the legacy company continues to shape the media landscape through its flagship networks like Fox News, Fox Sports and Fox Broadcasting Company.

The absence of major global events in the preceding fiscal year dented Fox’s major source of revenue ads. After a long-period of stagnant stock prices, it has seen a surge this year on the back of strong earnings per share for the first and second quarters. The company is poised to have a surge in earnings over the near term as the 2024 presidential race heats up.

Since Fox is the primary broadcaster with a right-wing tilt, in an increasingly polarized political climate, the media conglomerate stands to benefit no matter which way the results go. Strategic deals to acquire rights for the broadcast of football tournaments like the Euros and the World Cup in 2026 bolsters not only the company’s prospects, but also weakens its competitors.

The company also saw an amicable exchange of leadership as media mogul Rupert Murdoch stepped down in favor of his son, Lachlan, becoming CEO. How the company manages any potential conflicts in lieu of its leadership change along with its multiyear broadcasting deals and new ventures will determine its future growth trajectory.

Financials and operations analysis

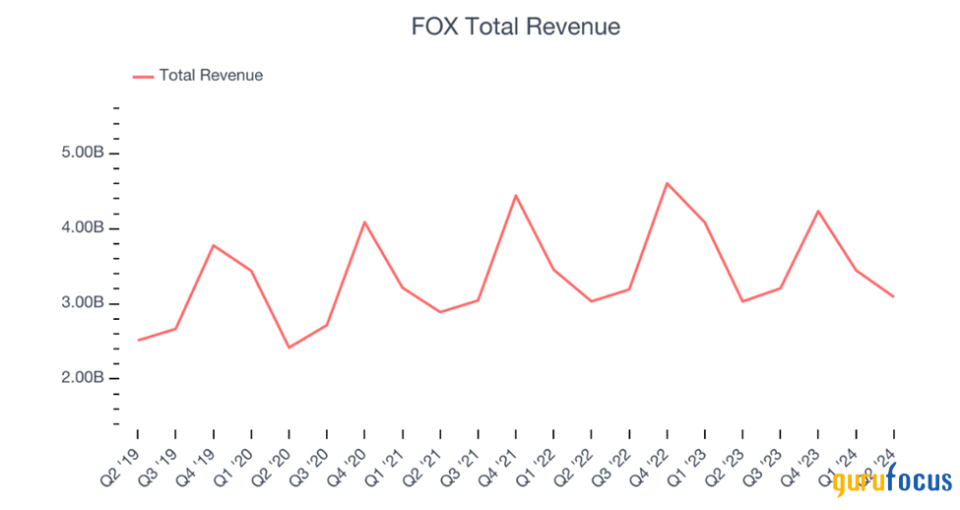

Fox registered a higher net income in fiscal 2023-24 as compared to 2022-23, but it did record a major restructuring expense in the prior year that depressed the final figure. Revenue, however, decreased by 6% for the year. The company’s advertising revenue, its main vehicle that drives business, decreased 18% due to the absence of marquee events like the FIFA World Cup in 2022 and the Super Bowl in Feb 2023 that accounted for a large chunk of advertising revenue previously. But this dip was met with a similar decrease in operating expenses compared to 2022-23 due to a reduction in production costs and rights amortizations associated with big sporting events.

Another one-off anomaly that affected Fox was being caught on the wrong side of the writer’s strike, which led to a decrease in content revenue. Management navigated this by infusing cash into the company through share buyback programs.

For a company like Fox, a dip in revenue is not necessarily a bad thing as the key business driver is ad revenue from events. With multiple important events in both politics and sports happening soon, the company is poised to reverse the downtrend. This trend is illustrated in the chart below, with every dip in revenue met by a subsequent increase for the following period.

From a financial management point of view, Fox is in a much better situation. The current ratio of 2.54 implies that Fox has more than twice the assets to cover near-term liabilities. The company is also sitting on $4.30 billion in cash, which is two-thirds the value of its outstanding long-term debt. The company has the resources required to manage its debt expenses as net cash from operations of $1.80 billion is three times the amount of public debt due in 2025 ($600 million). The next large debt due for the company is in 2029, by which time it can further strengthen its financial position from where it already is as of 2024.

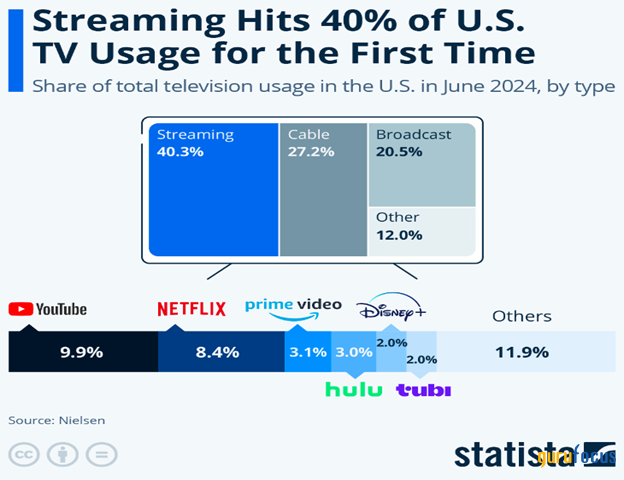

The major concern for Fox and investors interested in the company would be the affiliate fees segment. Even though affiliate fees increased, they were primarily driven by monthly subscription services, which saw an increase in higher average rates per subscriber, though there was a net loss in average number of subscribers across all formats. This can be a double-edged sword; although the company was able to drive revenue due to higher fees, the entire business model for a news and entertainment company relies on acquiring and retaining viewers, which can be a pain-point for Fox as it is in a low switching cost industry and operates in a landscape where consumers are quickly ditching cable television in favor of streaming platforms. How Fox will tackle this loss of subscribers will be critical to its future.

Stock performance

Class A shares of Fox hit a 52-week high tin late August, reaching $40.12, a price level not seen since March 2022. In the third quarter, trailing 12-month earnings of $3.20 per share were followed by $3.13 in the fourth quarter. The boost in earnings following four quarters of EPS below $2.504, may have prompted the steady rise in price seen this year.

Despite an elevated price relative to recent history, the stock is valued at a modest price-earnings ratio of 11.72. This is similar to Fox’s main competitor Comcast (NASDAQ:CMCSA) with an earnings multiple of 9.60, but better than Disney’s (NYSE:DIS) ratio of 19.34 and Warner Bros. Discovery’s (NASDAQ:WBD) negative ratio. The reasonable ratio is a reflection that the rise in price is the product of a similar rise in earnings.

The primary driver for the increase in earnings per share in 2024 is due to the large share buyback program instituted by the company; purchasing $4.6 billion worth of Class A shares, decreasing the weighted average shares by almost 10%. Fox employed prudent financial management, injecting fresh cash that can be put to the best use whilst also rewarding shareholders by allocating more of its capital to them in the form of buybacks and dividends. Fox has paid dividends consistently, increasing the value each year. These actions signal it is committed to returning value to shareholders.

Another factor of critical importance to a potential long-term investor is the low-price volatility of the stock. The 52-week range was $28.29 to $40.12 and the lowest it fell to was $21 at the start of the Covid-19 pandemic. The ability of the stock to withstand wild market swings is crucial to an investor looking to preserve their capital and earn income through buybacks or dividend payments.

Despite these positive actions taken by management, the stock as a whole has lagged the S&P500 Index on both a price return as well as a total return basis, as seen below.

This may indicate that Fox might be a capital preservation play, for the investor to draw from share buybacks and dividends rather than a stock whose value is driven by capital appreciation.

Near-term horizon

Following the success of the FIFA World Cup in 2022, Fox has continued to go all-in on sports broadcasting, acquiring the rights for both Euro ’24 and Copa America ’24, but as these events both concluded in July, their results will only be seen this fiscal year. The Copa America, which took place in the U.S., was a huge success in terms of viewership, with record local numbers arising from not just U.S. matches, but also from international matches. The company has also acquired the rights for both the FIFA Men’s World Cup in 2026 as well as the Women’s World Cup in 2027. The Men’s World Cup is of particular interest as it is taking place across the U.S., Canada and Mexico. Even though these events are down the line, they will be major drivers of ad revenue for Fox.

Another significant driver of ad revenue will be Super Bowl 2025, for which Fox has the broadcast rights. The event averages 100 million viewers locally and is the biggest sporting event from an American perspective. An average ad costs $7 million for 30 seconds of airtime, and with the total runtime of the entire event till the post-show clocking in at over four hours, Fox will be targeting the game to draw in a bulk of the ad revenues in 2025.

In the immediate future, all eyes turn to the 2024 presidential election. The U.S. is in the midst of an increasingly hostile political environment and citizens consider the election to be a pivotal moment that will determine the trajectory of the country. Fox is the biggest player with a right-wing viewpoint and as the country ramps up to the election in November, more and more people will be tuning in to analyze and debate over who deserves to become the next U.S. president.

Venu and Tubi streaming services

The big three of U.S. broadcasting, Disney, Fox and Warner Bros. Discovery, have collaborated on a combined venture to launch Venu Sports Streaming Service that is looking to go live in the fall with each partner owning one-third of the venture. The service will provide access to 14 live sports channels and is priced at $42.99 per month. The potential gains from Venu are endless, with an increasing portion of young viewers having never paid for a cable TV package, streaming is the way forward in the world of broadcasting. A critical aspect of this deal is the fact that it is a collaboration and not a competition between the big three broadcasters. If the streaming service can get online, is functional and can generate new viewers on a continuous basis, Fox stands to benefit immensely even if it owns only a third of the venture, as the lack of competition will imply Venu can potentially have a monopoly on sports streaming in the U.S.

Fox also acquired the streaming service Tubi in 2020, which offers an extensive library of movies, TV shows and exclusive originals. Tubi is the fastest-growing streaming service since its debut with 80 million active monthly users and is the most watched free TV and movie streaming service in the U.S. The service is preparing to enter the U.K. market as well, opening up more revenue streams.

The legacy media player has strategically positioned itself to dually benefit from the generational change from cable to streaming by capitalizing on both sports as well as entertainment streaming services. The graphic below illustrates the growth of the streaming services industry, so the success of these ventures is of critical value to Fox.

Outlook

Fox has positioned itself well to capitalize from the series of broadcasting deals it finalized over the past several years. With both the U.S. election and sporting events ranging from the Super Bowl to the FIFA World Cup, the company has strategically struck deals for events that are surefire revenue generators. The success or failure of these events will greatly impact the performance of the company. Management will have to be shrewd in order to prevent any conflicts of interest that may arise between Rupert Murdoch’s three other children and the current CEO and chair. For an investor focused on capital preservation, the low-volatility stock and the promise of future buyback programs, as well as increasing dividends, are an attractive prospect.

At this point, considering the modest price-earnings ratio, healthy balance sheet, increasing dividends, projected near-term increase in revenue and strategic acquisitions’ and deals in the world of streaming, I would suggest a long-term investor to hold or buy shares of Fox as I believe the company is fairly if not slightly undervalued at its current price. Several big events over the coming years will significantly increase ad revenue for the company. I believe it is well positioned to face any potential challenges in the coming years.

This article first appeared on GuruFocus.