Buying and holding top stocks for a long, long time is one of the best ways to make money in the stock market, because this strategy allows investors to capitalize on secular growth trends and also helps them benefit from the power of compounding.

For instance, a $500 investment made in the Nasdaq-100 Technology Sector index a decade ago is now worth $2,300, translating into annual growth of 16% during this period. So, if you have $500 to spare right now after paying off your bills, clearing expensive loans, and saving enough for rough times, it would be a good idea to put that money into shares of companies that are benefiting big-time from the growing adoption of artificial intelligence (AI).

That’s because the global AI market is forecast to grow at an annual rate of 28% through 2030, generating almost $827 billion in annual revenue at the end of the decade. The adoption of this technology is set to impact multiple industries, ranging from cloud computing to digital advertising.

In this article, I will examine the prospects of two companies that are operating in these niches and are already benefiting from the rapidly growing adoption of AI to see why it would make sense to invest $500 in them (either separately or combined).

1. The Trade Desk

The Trade Desk (NASDAQ: TTD) operates a programmatic, cloud-based advertising platform that helps advertisers purchase ad inventory and manage and optimize their campaigns across various channels such as video, mobile, e-commerce, connected television, and others. The Trade Desk’s automated platform uses real-time data to help drive stronger returns on investments for advertisers so that they can purchase and display the correct ads to the correct audience at the correct time.

It is worth noting that the company operates in a fast-growing niche as the programmatic advertising market is expected to generate incremental revenue of $725 billion between 2023 and 2028 at a compound annual growth rate of 39%, as per TechNavio. The Trade Desk has been relying on AI to capture this massive end-market opportunity.

The company launched its AI-enabled programmatic ad platform Kokai in June 2023. Kokai analyzes 13 million ad impressions every second so that it can “help advertisers buy the right ad impressions, at the right price, to reach the target audience at the best time.” The good part is that The Trade Desk’s customers are already witnessing an improvement in their returns on ad dollars spent thanks to Kokai.

On its August earnings conference call, The Trade Desk management pointed out:

For those campaigns that have moved from Solimar to Kokai in aggregate, incremental reach is up more than 70%.

Cost per acquisition has improved by about 27% as data elements per impression have gone up by about 30%. In addition, performance metrics have improved by about 25%, helping to unlock performance budgets on our platform for years to come.

Solimar is The Trade Desk’s programmatic ad platform that was launched in 2021. So, it won’t be surprising to see more of the company’s customers moving to the AI-enabled Kokai given the significant improvement in ad performance that it is delivering. More importantly, The Trade Desk’s focus on integrating AI has allowed it to accelerate its growth as well.

The company’s revenue in the second quarter of 2024 increased 26% year over year to $585 million as compared to the 23% growth it recorded in the same quarter last year. Its adjusted earnings increased at a faster pace of 39% from the same quarter last year to $0.39 per share. The company’s revenue forecast of $618 million for Q3 would translate into 27% growth from the same quarter last year, suggesting that its top-line growth is on track to accelerate in the current quarter.

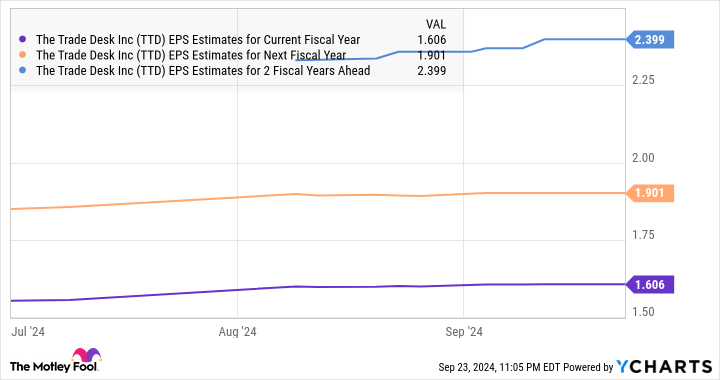

The good part is that analysts are expecting The Trade Desk’s earnings growth rate to pick up in the future.

TTD EPS Estimates for Current Fiscal Year data by YCharts

The company is expected to clock an annual earnings growth rate of 26% for the next five years, but recent trends and the huge addressable opportunity in the programmatic advertising market (which The Trade Desk management pegs at $1 trillion) suggest that it could outperform consensus estimates.

The market has rewarded The Trade Desk stock with 50% gains in 2024 so far thanks to its improving growth profile, and its bright prospects suggest that it could keep flying higher. That’s why investing $500 in The Trade Desk could turn out to be a smart long-term move right now considering that it has a price/earnings-to-growth ratio (PEG ratio) of 0.6, which means that it is undervalued with respect to the growth that it is forecasted to deliver.

2. Oracle

The cloud computing market has been a big beneficiary of the growing AI adoption in the initial days, Grand View Research estimates that the cloud AI market could grow at an annual rate of 40% through 2030 to generate revenue of $647 billion at the end of the forecast period. Oracle (NYSE: ORCL) is getting a big boost thanks to the rapid growth of the cloud AI market, as evident from the company’s recent results.

Oracle’s cloud revenue in the first quarter of fiscal 2025 (which ended on Aug. 31) increased 21% year over year to $5.6 billion, outpacing the company’s total revenue growth of 8% to $13.3 billion. More specifically, the Oracle Cloud Infrastructure (OCI) business recorded terrific year-over-year growth of 45% to $2.2 billion.

OCI is the company’s infrastructure-as-a-service (IaaS) business through which it rents out its cloud infrastructure to customers looking to train AI models. Management points out that this business now has an annual revenue run rate of $8.6 billion and demand for OCI is exceeding supply. The demand for Oracle’s cloud infrastructure offering is so strong that its remaining performance obligations (RPO) shot up a terrific 52% year over year in the previous quarter to $99 billion.

RPO is the total value of a company’s future contracts that are yet to be fulfilled, and it is worth noting that AI is playing a central role in driving this metric higher. Oracle points out that its “cloud RPO grew more than 80% and now represents nearly three-fourths of total RPO.”

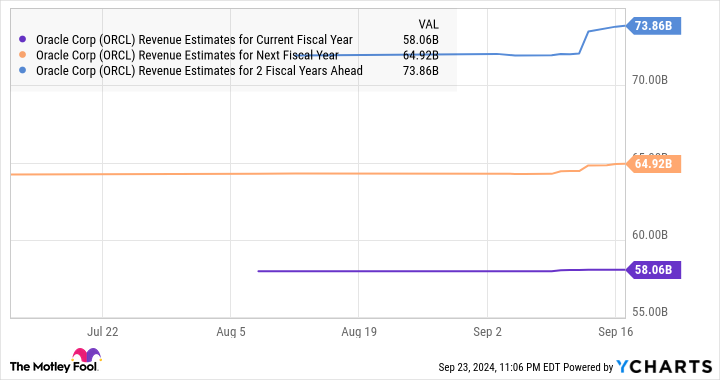

Considering the huge opportunity that’s present in the cloud AI market, it won’t be surprising to see demand for Oracle’s cloud infrastructure increase at a robust pace for a long time to come. This is also the reason why consensus estimates are projecting Oracle’s revenue to increase by double digits over the next three fiscal years following a top-line jump of just 6% in fiscal 2024 to $53 billion.

ORCL Revenue Estimates for Current Fiscal Year data by YCharts

Oracle is up 57% so far in 2024. Investors would do well to act quickly to add this cloud stock to their portfolios as it is still trading at an attractive 27 times forward earnings, a small discount to the Nasdaq-100 index’s forward earnings multiple of 29. Its huge addressable market and the immense size of its backlog that’s growing on account of the rapid adoption of cloud AI services is likely to lead to more stock price upside in the future.

Should you invest $1,000 in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle and The Trade Desk. The Motley Fool has a disclosure policy.

Got $500? 2 Monster Artificial Intelligence (AI) Stocks to Buy Right Now was originally published by The Motley Fool