Chevron (NYSE: CVX) ranks among the world’s largest oil and natural gas companies. It has a long history of operating in a fiscally conservative manner. And it also has a long history of rewarding investors with regular dividend hikes even when energy prices are weak. If you are looking for an energy stock, it is probably worth a closer look. While it has been cheaper in the past, now wouldn’t be a bad time to buy it.

Here’s what you need to know.

Is it always a good time to buy Chevron?

Based on valuation, Chevron will be far more attractive at some points and less so at others. That’s just how Wall Street works. However, from a broader energy sector perspective, Chevron is always an attractive company. Some facts will help here.

For starters, Chevron’s business is spread across the entire sector since it is what’s known as an integrated energy company. So it has exposure to oil and natural gas production (upstream), energy transportation (midstream), and chemicals and refining (downstream). Each of these industry segments tend to perform differently at given times.

Notably, the downstream often benefits from the low oil and gas prices that hurt the upstream. The pipelines that populate the midstream tend to generate reliable cash flows through the entire energy cycle. So Chevron’s diversified business helps to soften the inherent peaks and valleys of the highly volatile energy sector.

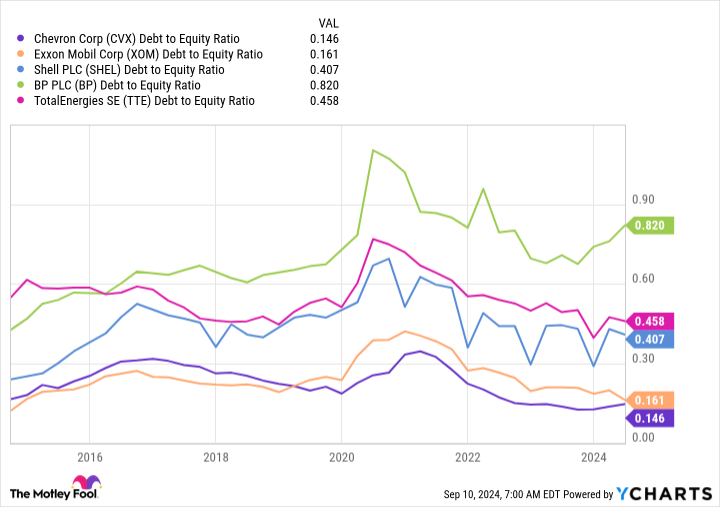

On top of that, Chevron has one of the strongest balance sheets of its closest peer group. Its debt-to-equity ratio of roughly 0.15 would be low for any company. But the really important fact is that it provides Chevron with the financial leeway to add leverage during industry downturns so it can continue to support its business and dividend. The dividend notably has been increased annually for 37 consecutive years despite the many swings in energy prices over that span.

Basically, if you are looking for an energy company, Chevron should probably be on your short list. That’s not a time-dependent statement — always keep Chevron on your energy short list.

Chevron seems reasonably priced right now

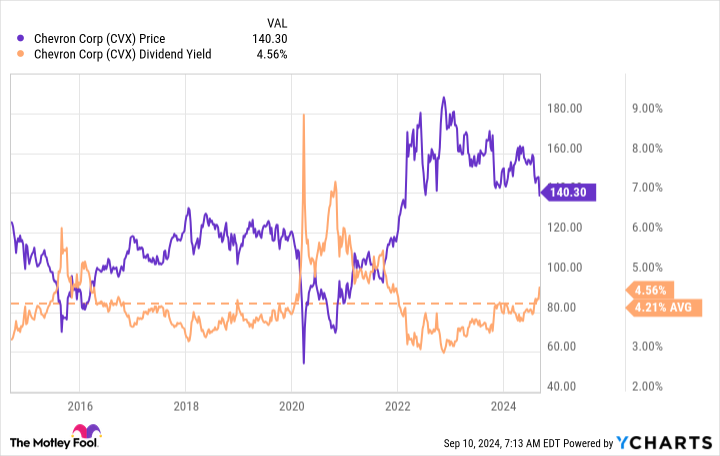

That said, Chevron isn’t a screaming buy today. But it does look reasonably priced. Because of the inherent volatility of earnings in the energy patch, typical valuation metrics aren’t all that useful when looking at Chevron. But given the consistency of the dividend over time, dividend yield can be a pretty useful tool. When the yield is high, Chevron is probably attractively priced. When the yield is low, Chevron is likely to be on the expensive side.

Right now, Chevron’s roughly 4.6% dividend yield is above its 10-year average yield of about 4.2%. This suggests that Chevron is a little cheap today. So if you are considering it, now might be a good time to add it to your portfolio.

Understand that Chevron swings with oil

That said, despite a diversified portfolio of energy businesses, Chevron’s top and bottom lines are still heavily impacted by the price of oil and natural gas. When energy prices are high, earnings will be high. When energy prices are low, earnings will be low. Investors react accordingly. The best time to buy Chevron is often during energy downturns. It takes a bit of a contrarian streak to jump in at that point, but the dividend yield can get up toward 10% when Wall Street is really worried about energy prices.

Given the current yield, that obviously isn’t the issue today. But energy prices have been pulling back a little bit on supply/demand issues. And, if you are looking for a long-term energy stock to add to your portfolio, Chevron could be a good addition. Just go in knowing that there’s going to be a time when the stock plunges along with oil prices. That will probably be the time to add to your position, however, not the time to sell in a panic.

Chevron is a buy, if you buy for the right reasons

If you are trying to play the ups and downs of energy prices, Chevron will be a terrible choice for your portfolio. That’s probably not the best way to invest for most people, anyway. What Chevron does — and does well — is provide broad exposure to the energy sector with a dividend that is reliable through the entire cycle. And given the above average yield today, it is probably worth adding at least a starter position in the stock if you have been looking at it.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Is Chevron Stock a Buy? was originally published by The Motley Fool