Medical device specialist DexCom (NASDAQ: DXCM) is going through a rough patch. The company’s shares dropped off a cliff following its second-quarter earnings report. However, zooming out helps put things in perspective. The healthcare company has generally delivered returns that are well above average. Can DexCom continue doing that long enough to be a millionaire-maker stock for investors who get in today? Let’s find out.

What DexCom does

DexCom is a leader in the market for continuous glucose monitoring (CGM) systems, devices that allow diabetics to keep track of their blood glucose levels. This field is practically a duopoly DexCom shares with Abbott Laboratories. CGMs are better mousetraps than manually operated blood glucose meters that can only tell a person’s sugar level at a particular time. CGMs do so automatically and continuously throughout the day. They can also be paired with pumps to automate the insulin delivery process. Many studies have concluded that CGMs help diabetes patients achieve better health outcomes.

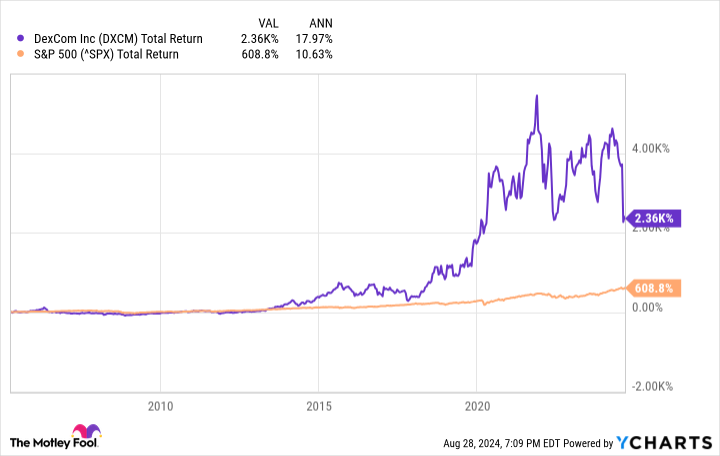

DexCom has been successful precisely because it has helped increase the adoption of this technology. Revenue, earnings, and stock performance have been impressive, if a bit volatile, since its 2005 IPO.

Note that a $50,000 investment in DexCom at its IPO would be worth more than $1 million today.

The opportunities

Is there enough growth fuel left? Globally, yes. DexCom and Abbott Laboratories have barely scratched the surface of the worldwide diabetes market. Of the half a billion adults with diabetes, only 1% use CGM technology. DexCom’s problem is that most of these patients are in second- and third-world countries where it doesn’t operate. However, its addressable market should expand as it enters more regions. That’s what DexCom has done in the past. Further, the company is building a competitive advantage through the network effect.

DexCom’s CGM devices are compatible with other gadgets and apps. Devices compatible with DexCom’s G6, G7, or DexCom ONE include Tandem Diabetes Care t:slim X2, Insulet Omnipod 5, some of Eli Lilly‘s and Novo Nordisk‘s insulin pens, and the Apple Watch. Glooko, a privately held company that provides digital health solutions for diabetes patients, also works with DexCom. The more patients within DexCom’s installed base of CGM customers, the more attractive it is for other companies to make their diabetes-centered products and services compatible with DexCom’s.

So, newcomers in the field will have difficulty wresting customers away from DexCom. And while another company could create a better CGM device, DexCom has proven incredibly innovative. Its newest G7 is the most accurate CGM on the market.

The risks

Several things could derail DexCom’s long-term plans. For instance, some drugmakers are working on potential functional cures for type 1 diabetes. The list includes Vertex Pharmaceuticals and CRISPR Therapeutics. Data from an ongoing phase 1/2 study shows that patients treated with Vertex’s VX-880 showed improvement, including glucose-responsive insulin production by day 90 (people with type 1 diabetes typically don’t produce insulin). Three of them, who had more than a year of follow-up, showed insulin independence.

That’s excellent news for Vertex and these patients. If these efforts are successful, DexCom’s addressable market could decrease, although not too much. The overwhelming majority of people with diabetes — between 90% and 95% in the U.S. — suffer from the type 2 variety. Still, that’s something to keep in mind. Elsewhere, Apple has been trying to develop a CGM option within its smartwatch, something else that could undermine DexCom’s business considering Apple’s massive brand power and installed base. These efforts also seem to be in their early stages, though, and there is no telling if they will be successful.

Lastly, DexCom’s shares look expensive.

As of this writing, the healthcare industry’s average forward price-to-earnings ratio is 19.5. How much will that matter in more than 10 years, though? Probably not much.

The verdict

DexCom’s recent plunge was due to short-term issues, including patients taking advantage of rebates more than anticipated and a slower adoption of its G7 than it had hoped. These headwinds will subside, and the stock still has incredibly attractive long-term prospects. DexCom might not perform quite as well in the next 20 years as it has since 2005, but it can still help patient investors become millionaires. “Patient” is the keyword, though, as this won’t happen overnight.

Should you invest $1,000 in DexCom right now?

Before you buy stock in DexCom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DexCom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Abbott Laboratories, Apple, CRISPR Therapeutics, and Vertex Pharmaceuticals. The Motley Fool recommends DexCom, Insulet, and Novo Nordisk. The Motley Fool has a disclosure policy.

Is DexCom a Millionaire-Maker Stock? was originally published by The Motley Fool