As your first year of retirement progresses, it’s important to evaluate whether the financial plan you laid out to ensure your sustainable well-being is going according to plan. An appropriate plan should include tax calculations to understand how much of your income will truly be at your disposal for needs and wants.

Some people may think that because you pay for Social Security benefits throughout your lifetime via payroll taxes, it’s a tax-free benefit. However, this is often not the case. Both the amount of your Social Security benefits subject to taxes and the tax rate itself will depend on a handful of factors personal to your situation.

To build your own retirement income plan and tax strategy, talk to a fiduciary financial advisor today.

How Your Social Security Benefits Are Taxed

In short, you might pay taxes on 0%, 50% or 85% of your Social Security retirement benefits. This is depending on your provisional income, though:

Provisional income = Taxable income + Tax-exempt interest + ½ of annual Social Security benefits

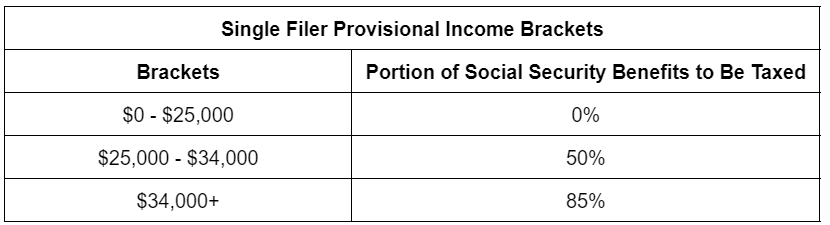

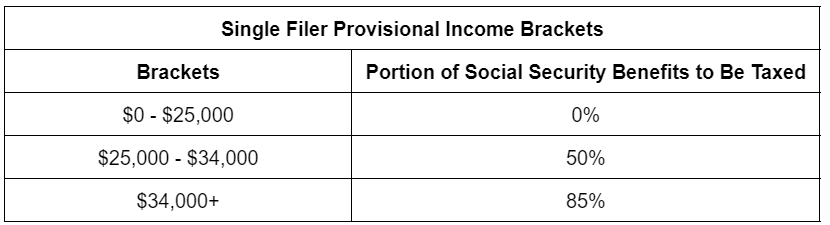

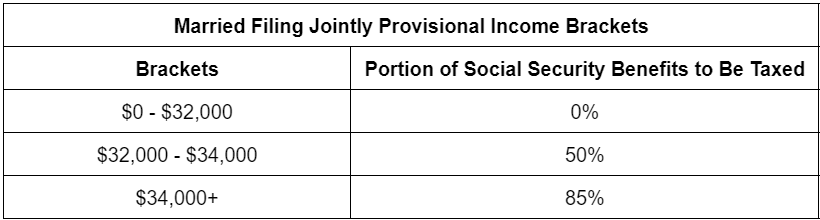

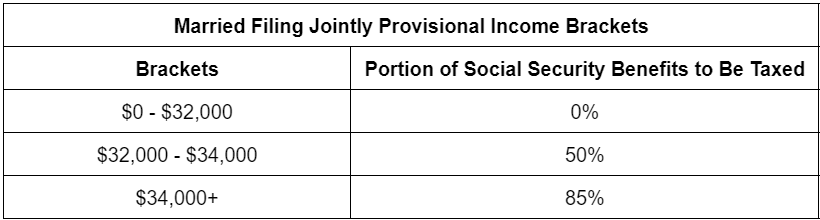

You then would compare your provisional income to that year’s income threshold to determine what portion of your Social Security benefits will be taxed. Your tax rate will be your marginal rate. For a single filer, the thresholds are as follows for the 2023 tax year:

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

For example, if you had $25,000 in 401(k) withdrawals, $5,000 in tax-exempt bond interest and $29,000 in annual Social Security benefits, your provisional income would be:

$25,000 + $5,000 + (½ x $29,000) = $44,500

Because this is beyond the $34,000 income threshold, 85% of your Social Security income will be taxed.

So, nearly $25,000 of your Social Security benefits ($29,000 x 0.85 = $24,650) for the year would be taxable in this case. Again, that’s only the amount of money you’ll be charged taxes on – not what you’re actually paying in taxes. The other roughly $4,000 would be tax-free.

Talk to a financial advisor about building a strategy to minimize taxes in retirement.

Delaying 401(k) and IRA Distributions

In some cases, it may make sense to reduce your other income streams to prevent additional taxation of your Social Security benefits. While some advisors may recommend their client delays taking Social Security as long as possible to get increased benefits, it might be helpful to reduce the tax liability on Social Security income by delaying other income streams instead. For instance, you could push back distributions from a 401(k) or traditional IRA.

This is because any 401(k) or IRA distributions you take in a year will count toward your provisional income, putting you at risk of increased taxes on your Social Security benefits. However, in some cases this tradeoff may be well worth it, such as if you converted your 401(k) or IRA to a Roth IRA to save on taxes in the future. A financial advisor can help you do the calculations to see which strategy could be more beneficial.

Dealing With and Managing Your RMDs

If you’re in your 70s, you may be already taking or preparing to take required minimum distributions (RMDs) from your retirement accounts. RMDs will necessarily increase your provisional income in a lot of cases, but there may be ways to keep this income out of your provisional income to keep your tax rate on your Social Security benefits low.

For example, you can preempt the taxes by converting your 401(k) or traditional IRA to a Roth IRA. While this will trigger a tax bill up front, it may save even more than just taxes on your Social Security benefits in the long run, since Roth IRA distributions are tax-free. Note that you often cannot make penalty-free withdrawals from a Roth IRA within five years of opening an account, however.

Another alternative is to take an RMD as a qualified charitable distribution, or QCD, if you don’t need the money. QCDs are excluded from your taxable income and wouldn’t push you into a higher threshold of provisional income.

Consider speaking with a financial advisor about ways to navigate RMDs within your retirement income plan.

Bottom Line

It’s important to plan for Social Security taxes in your overall retirement budget. Note that the portion of your benefits that are subject to taxes may change each year depending on your other income streams. In turn, you’ll want to plan ahead each year for these considerations.

Retirement Planning Tips

-

As you plan for your golden years, it’s important to get an accurate estimate of how much money you’ll have saved up by the time you retire. Luckily, SmartAsset’s retirement calculator can help you project how much money you may need to retire and whether you’re on track to hit this target.

-

A financial advisor can help you navigate the sometimes complex world of retirement planning. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/FG Trade

The post This Is My First Year Taking Social Security. How Do I Reduce My Taxes on It? appeared first on SmartReads by SmartAsset.