We recently compiled a list of the 35 Trending AI Stocks on Latest Analyst Ratings and News. In this article, we are going to take a look at where GE Vernova Inc. (NYSE:GEV) stands against the other trending AI stocks.

As the earnings season unfolds, investors are eager to see how artificial intelligence (AI) investments among S&P 500 companies are yielding results. Analysts anticipate profit growth to decelerate, with S&P 500 earnings projected to rise by 5.3% compared to the same quarter last year, down from a 13.2% increase in the second quarter, per a report by news agency Reuters. The technology and communication services sectors are expected to show the strongest year-over-year growth, with technology earnings forecasted to increase by 15.4% and communication services by 12.3%. AI-related firms have dominated earnings narratives since last year, driving substantial market gains. The S&P 500 is currently at record highs, having risen approximately 21% year-to-date, largely fueled by robust performance in the tech and communication sectors.

Read more about these developments by accessing 10 Unsexy AI Stocks According to Goldman Sachs and 10 Buzzing AI Stocks According to Goldman Sachs.

Howard Chan, CEO of Kurv Investment Management, noted that analysts are keen to evaluate how major companies monetize their AI initiatives, with those succeeding in this regard being notably rewarded. Meta, for instance, experienced a surge in share prices after projecting strong sales growth, suggesting that its digital ad revenue is effectively funding its AI investments. Conversely, the expenditures of giants like Google on AI technologies have raised questions regarding their integration with existing business models. With the S&P 500 trading at 22.3 times future 12-month earnings estimates, surpassing its long-term average of 15.7, many investors hope that this quarter’s earnings will justify higher stock valuations. Solita Marcelli from UBS Global Wealth Management expressed optimism that upcoming third-quarter results could catalyze further gains, particularly as the semiconductor sector remains a focal point for AI investment.

Read more about these developments by accessing 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

Our Methodology

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

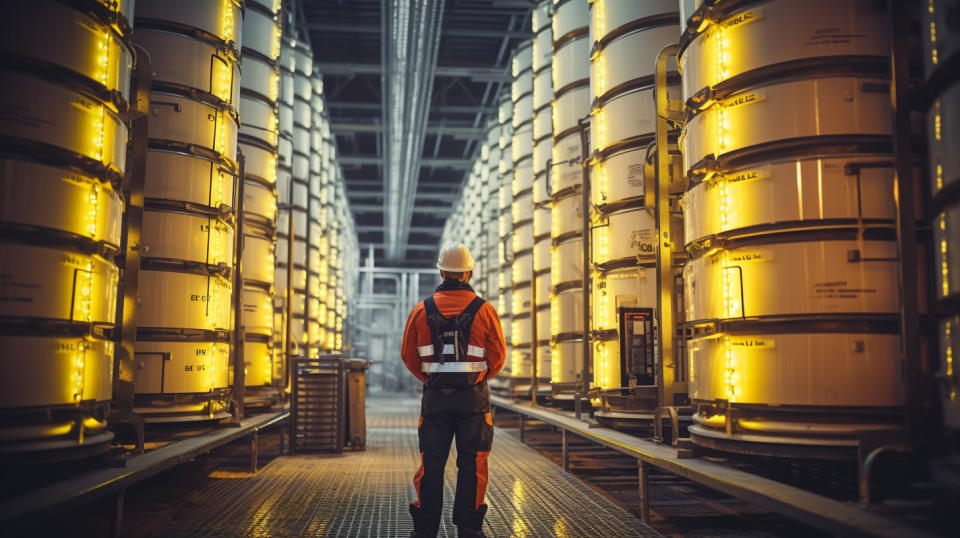

A technician wearing a safety vest standing alongside a commercial-scale energy storage stack.

GE Vernova Inc. (NYSE:GEV)

Number of Hedge Fund Holders: 92

GE Vernova Inc. (NYSE:GEV) is an energy company that engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity. JPMorgan analyst Mark Strouse recently raised the price target on the stock to $285 from $240 and kept an Overweight rating on the shares. Given the company already preannounced Q3 EBITDA, the investment firm views the December 10 investor event as a relatively larger catalyst for the stock. Expectations are elevated with the stock 101% since the spinoff and the new long-term financial targets to be issued at the December 10 event could potentially disappoint if management continues with its cadence of setting conservative targets, the advisory told investors in a research note. However, JPMorgan believes GE Vernova remains a key beneficiary of the US electric load growth theme, which is still very early in the cycle. It believes that macro announcements and backlog growth could provide additional visibility into both the company’s revenue and margin upside in 2027 and beyond.

Overall GEV ranks 14th on our list of the trending AI stocks. While we acknowledge the potential of GEV as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than GEV but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.