The artificial intelligence (AI) industry doesn’t have quite the sheen as it did earlier this summer. Investors have become increasingly wary of the technology’s ability to deliver real-world value — at least in a time frame that justifies the sky-high stock valuations investors have seen.

At the heart of this lies the technology’s posterchild, Nvidia (NASDAQ: NVDA). The chipmaker’s stock is down about 15% since it reported second-quarter earnings on Aug. 28. That’s nearly half-a-trillion dollars — $470 billion — in market capitalization wiped out in a week. It’s an incredible amount. There are only 15 companies on the planet with a market cap that exceeds what the company lost in a week. That shows just how big Nvidia is.

That kind of drop may make you nervous. It makes me nervous. Before you jump ship, however, let’s consider some more context.

The market as a whole is shaky

Most companies in the AI space are getting hammered. It’s not just AI though; the whole market is down. There are a lot of factors at play. For starters, investors are looking to see more data — like a new jobs report — that will help indicate the direction the economy is headed. Tied to this will be the Fed’s decision in the coming weeks on whether to cut rates and, critically, by how much. So Nvidia’s slide comes as the market as a whole is down; the company is not alone.

Another likely factor to consider is that many investors are simply taking a profit. Some were likely waiting to see if the company’s Q2 report would blow expectations out of the water once again. Although in many ways it did exceed expectations, it wasn’t enough to send the stock flying, and it didn’t indicate what might be just around the corner. These investors are choosing to realize the incredible returns they’ve seen over the past few years given they don’t believe the stock is going to jump anytime soon.

Nvidia remains in an extremely solid position

Whatever the reason Nvidia’s stock dropped, it’s not that important in the long run. This is a distraction. Do you still believe in Nvidia’s long-term prospects? I do.

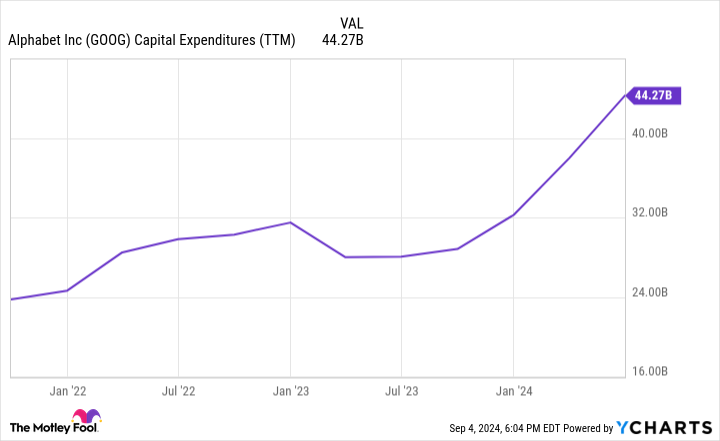

In the medium term, there is ample reason to see growth continue. It might not hit the levels it has in recent quarters, more than tripling revenue year over year , but high double-digit growth is nothing to shake a stick at. Fears over revenue streams drying up, at least anytime soon, are overblown. If you look at the giant tech companies that buy Nvidia’s chips, like Meta and Alphabet, their latest-earnings calls show a clear intent to not just continue but to expand spending on AI infrastructure. The gravy train isn’t slowing any time soon.

Look at the massive increase in capital expenditures from Alphabet over the last three years. Notice the sharp upswing in the last year?

Thinking more long term now, the value proposition for Nvidia remains. AI is likely to transform the economy, and Nvidia is firmly placed in the middle of this transformation. Of course, Nividia is beset on all sides by competitors vying for that place, and the company will have to work diligently to stay ahead of the curve. But for my money, if there is a company that can do it, it is Nvidia. It has shown incredible foresight and an ability to innovate and pivot when it sees new opportunities.

I think investors are likely to see more concrete examples of AI’s impact on companies’ bottom lines in the next year, and I believe it will renew investors’ faith in AI as a whole and Nvidia as its champion.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Loses $470 Billion in Value in a Week. Should Investors Be Worried? was originally published by The Motley Fool