If you invested $100 in Nvidia (NASDAQ: NVDA) at the beginning of 2023, you would now have $830 thanks to the remarkable surge in the company’s shares fueled by artificial intelligence (AI). Even so, the stock could jump from about $120 now to around $800 by 2030, according to one analyst.

Phil Panaro, a former senior advisor at the Boston Consulting Group, believes that the continuing growth of AI and the arrival of Nvidia’s next-generation Blackwell processors could lead to annual revenue of $600 billion in 2030 from $61 billion in fiscal 2024.

Let’s look at the catalysts mentioned by Panaro and check if they are strong enough to help Nvidia sustain its phenomenal growth in the long run.

The increasing demand for accelerated computing

Nvidia CEO Jensen Huang said on his company’s August earnings conference call that accelerated computing is going to be a long-term growth driver. Huang said the transition from general-purpose computing — using central processing units (CPUs) — to accelerated computing based on graphics processing units (GPUs) could help reduce computing costs by 90%.

Because GPUs speed up demanding workloads in data centers that would have otherwise taken longer using CPUs, Nvidia says, accelerated computing is not only faster, but it is also more sustainable because of its smaller energy footprint.

Huang projected “$1 trillion worth of data centers in a few years will be all accelerated computing” based on their energy efficiency.

Data centers are estimated to account for 1% to 2% of global energy consumption, a figure expected to double by the end of the decade. So the much faster pace of GPUs compared to CPUs is expected to help reduce energy consumption long term.

The demand for data center accelerators is forecast to have a compound annual growth rate (CAGR) of 28% through the next five years. And the massive end market that the transition to accelerated computing is likely to create, Huang said, could mean that his company is at the beginning of a phenomenal growth curve.

That’s because Nvidia is the dominant player in the data center GPU market. It reportedly controlled 98% of this space at the end of last year, so it stands to win big from the secular growth in accelerated computing even if it loses some of that market share.

The outlook for Nvidia’s upcoming Blackwell AI GPUs seems to be solid, with the company saying demand is tracking ahead of supply, a trend that’s likely to continue next year as well.

Why a $600 billion top line seems achievable

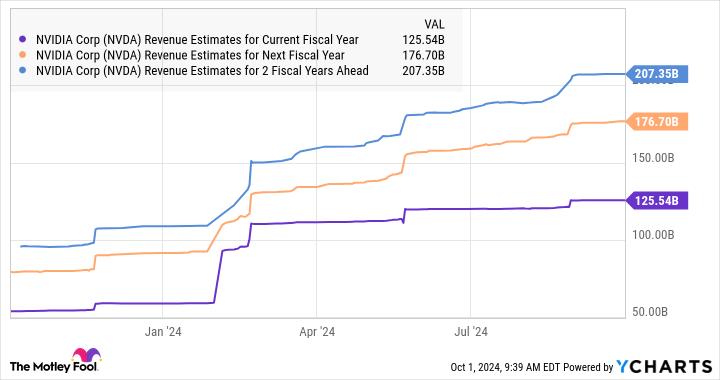

Nvidia’s solid prospects discussed above help explain why the company’s revenue estimates have received a nice bump for the next three fiscal years.

As shown in the chart above, Nvidia’s top line is expected to cross $207 billion in fiscal 2027, more than triple its fiscal 2024 revenue. The company’s fiscal 2027 will coincide with the majority of calendar year 2026. So to hit $600 billion in revenue by calendar year 2030 (Nvidia’s fiscal 2031), it will need an annual growth rate of 30% over a four-year period.

Nvidia serves multiple fast-growing markets such as AI chips (expected to grow at an annual pace of 41% through 2032), digital twins, and cloud gaming, so there is a good chance that it could indeed hit $600 billion in revenue by the 2030 calendar year. But it remains to be seen if that growth translates into the potential upside that Panaro predicts for the stock.

Assuming Nvidia does reach $600 billion in sales in 2030, the stock will have to maintain its current price-to-sales ratio (P/S) of 32 to generate 561% returns from this level. That would translate into a market cap of $19.2 trillion, compared to the current level of just under $3 trillion.

If we don’t give Nvidia such a rich sales multiple and assume that it is trading at a P/S of 8 (in line with the U.S. technology sector’s average) by 2030, its market cap would jump to $4.8 trillion.

So, Nvidia could deliver 61% gains from current levels assuming it trades at a more reasonable valuation. But if the market decides to keep rewarding the company with a rich multiple because of its healthy growth, there is a good chance that it could deliver a much stronger upside in the long run — and might even get close to Panaro’s ambitious estimate.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Stock Could Soar Another 561%, According to a Wall Street Analyst was originally published by The Motley Fool