What started as an artificial intelligence (AI) and growth stock-driven rally has blossomed into a widespread flurry of higher equity prices. Growth-oriented sectors, like technology and communications, are no longer the sole winners. Of the 11 Vanguard sector exchange-traded funds (ETFs), 10 are down less than 5% from their 52-week highs. Even stodgy and safe sectors are putting up monster gains.

Here’s why a broader rally is better than a rally driven by a few sectors and how to navigate a bull market when valuations are getting more expensive.

Dissecting the market rally

Vanguard offers low-cost ETFs for all 11 stock market sectors, with expense ratios between 0.1% and 0.13%, or $1 to $1.30 in annual fees for every $1,000 invested.

Sector ETFs can be a great way to achieve diversification, especially when you can’t decide among several investment opportunities. For example, utilities tend to have regional operations and vary from electricity providers to gas, water, and more. The Vanguard Utility ETF (NYSEMKT: VPU) provides an easy way to protect against natural disasters and smooth out risk across different industries and geographies.

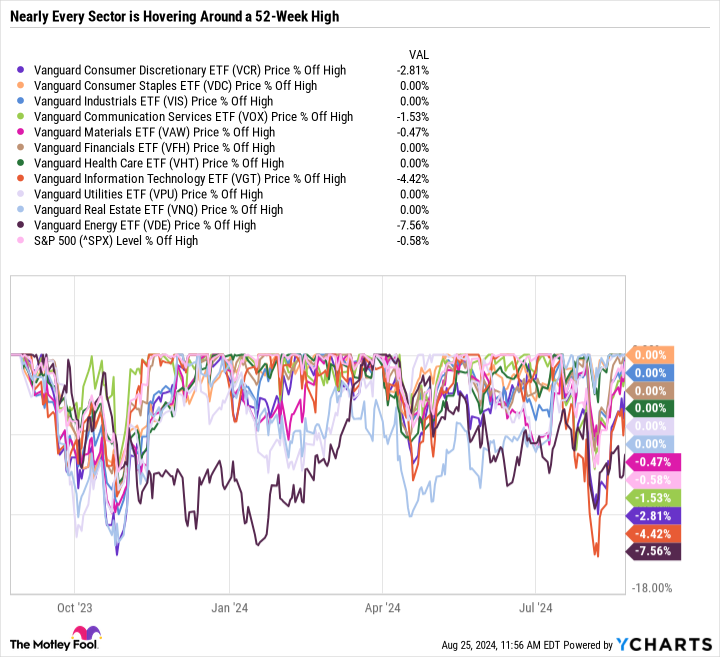

As you can see in the chart, every sector except energy is down less than 5% from its 52-week high, the S&P 500 is off less than 1% from its high, and six sectors are at 52-week highs.

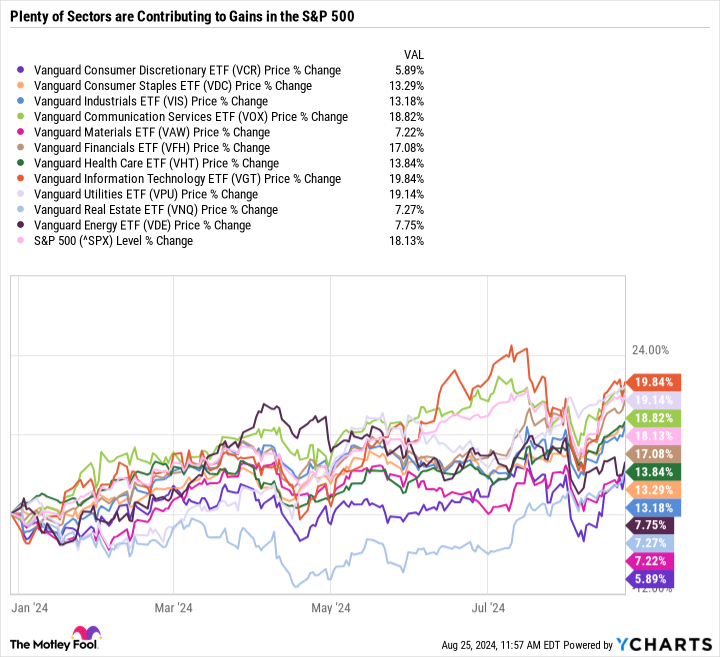

What’s more, all 11 sectors have gained year to date, with no individual sector outperforming the S&P 500 by a wide margin. Technology, utilities, and communications are slightly beating the S&P 500 but only by less than 2 percentage points.

The tech sector makes up over 31% of the S&P 500 and has been the key driver of the index in recent years, given its exposure to the fast-growing software, hardware, and semiconductor industries. Seeing traditionally low-growth sectors, like utilities, healthcare, and consumer staples, put up impressive gains (in addition to the tech sector) is a great sign that the stock market rally is becoming healthier so that a sell-off in a few sectors won’t necessarily derail the bull market.

Everyone’s a winner

The characteristics that may attract an investor to a high-octane growth opportunity like Nvidia differ from a company like Coca-Cola. Nvidia is an expensive stock primarily valued based on future earnings potential and a sustained boom in demand for its graphics processing units rather than what it is making today. By contrast, Coca-Cola has paid and raised its dividend for 62 consecutive years and is valued based on its track record, global reach, and diversified beverage brand portfolio spanning soda, juice, energy drinks, coffee, tea, water, and sparkling water.

Despite their differences, Nvidia and Coca-Cola are both hovering around all-time highs. So are UnitedHealth — one of the most valuable health insurance providers — JPMorgan Chase, Lockheed Martin, Procter & Gamble, Apple, and Meta Platforms, to name a few. In sum, investors are optimistic about the broader economy, not just a particular theme or investment opportunity.

Navigating a bull market

Markets like this are great for investors with established positions in top companies. But it can be difficult to find bargains in an expensive market, especially for investors just starting or those looking to put new capital in the market. After all, no one wants to lose money by investing in the market at its peak only to watch it sell off.

No one knows when there will be another recession, market correction, or bear market — but they will inevitably happen. Volatility is simply the price of admission for unlocking gains in the stock market. So, instead of hoping to dodge a sell-off, a better approach is to invest in companies or ETFs you are comfortable holding through periods of volatility. Understanding a company’s investment thesis and what will likely drive the stock’s long-term performance can help filter out the noise during a sell-off.

It’s also essential to align your holdings with your risk tolerance. If you are investing for a retirement that is decades away, then it doesn’t really matter what the stock market does in the coming quarters or years. But if you are a risk-averse investor looking to supplement income in retirement and preserve capital, investing in safe companies that can do well even during a major downturn could be a better strategy.

Should you invest $1,000 in Vanguard World Fund – Vanguard Utilities ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Utilities ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Utilities ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, JPMorgan Chase, Meta Platforms, Nvidia, and Vanguard Real Estate ETF. The Motley Fool recommends Lockheed Martin and UnitedHealth Group. The Motley Fool has a disclosure policy.

Only 1 Vanguard Sector ETF Is Down More Than 5% From Its 52-Week High. Here’s What That Means for Investors in Value, Dividend, and Growth Stocks. was originally published by The Motley Fool