On Aug. 28, Wall Street held its breath as the world’s most important artificial intelligence (AI) company reported second-quarter earnings. I’m talking about Nvidia (NASDAQ: NVDA), of course. While each member of the “Magnificent Seven” is seen as an indicator for the direction of all things AI, Nvidia has emerged as perhaps the industry’s end-all-be-all barometer.

But fear not! Once again, Nvidia silenced the doubters after posting yet another spectacular earnings report. However, while combing through the financial and operating metrics, I discovered one announcement that left me a little perplexed.

Namely, Nvidia’s board of directors approved an additional $50 billion in share repurchases (this comes on top of a remaining $7.5 billion from a prior buyback program). There’s a general notion that stock buybacks can be quite favorable for investors. But in the case of Nvidia, I just don’t get it.

Below, I’ll break down some reasons why I think Nvidia announced the buyback and why I do not see this move as a reason to buy the stock right now.

Is Nvidia’s buyback a distraction?

One of the bigger announcements from Nvidia this year was the company’s 10-for-1 stock split, which occurred back in June. Since early September 2022, shares of Nvidia have risen over 750%. As the stock price eclipsed $1,000 per share, building a position in Nvidia became more of a hurdle for some investors.

Sometimes, a company will choose to split its stock following these significant rises in the share price. Although a stock split does not inherently change a company’s market capitalization, the lower split-adjusted price is often perceived as less expensive and may inspire investors to buy. As a result, a stock could actually become more expensive following a split as a larger body of investors starts to pour in.

This isn’t exactly the case with Nvidia stock, though. Since shares began trading on a split-adjusted basis on June 10, Nvidia stock has declined by about 2% (as of market close on Sept. 2). I’ll concede that a 2% drop is not a reason to panic. But with that said, I am a little surprised that the split did not inspire a noticeable uptick in buying activity and subsequently propel Nvidia’s valuation to new highs.

To be candid, I see the announcement of the buyback as somewhat of a PR stunt and an effort to reinspire investors.

Does Nvidia’s buyback make strategic sense?

Imagine watching a commercial in which a celebrity you admire endorses a product, but later, you learn that the celebrity has never used the product and simply promoted it because they were paid a fee to do so. In a way, that’s sort of what’s going on with Nvidia right now.

While adding to the existing buyback initiative might give the impression that management views the stock as a good buying opportunity or even undervalued, keep in mind that insider selling has become all the rage at Nvidia over the last couple of months. Executives, including Nvidia’s CEO, Jensen Huang; executive vice president of operations, Debora Shoquist; and board members Mark Stevens and Tench Coxe were all selling stock when Nvidia shares were riding high earlier in the summer.

Why should you buy Nvidia stock when those responsible for generating shareholder value are cashing out? Perhaps this is a harsh criticism, as Nvidia’s executives still own large chunks of stock — making their net worth closely tied to the performance of the business. Nevertheless, I have some other concerns regarding the buyback.

While Nvidia is best known for its graphics processing units (GPUs), not too long ago, I wrote a piece on how the company is deploying its record profits into growth initiatives outside its core semiconductor and data center businesses. Moreover, considering Nvidia’s closest competitor, Advanced Micro Devices (AMD), has made several notable acquisitions over just the last couple of years, I would think management would be motivated to double down on research and development, marketing, and other endeavors amid intensifying competition. I would see those as more prudent decisions, considering Nvidia did have to delay orders on its newest Blackwell GPUs due to a design flaw.

One last point I’d like to make pertains to competition outside of AMD. Nvidia is also facing surging competition from its own customers — particularly some of the Magnificent Seven members. Electric vehicle (EV) manufacturer Tesla relies heavily on Nvidia chips to develop autonomous driving software. But recent remarks from Elon Musk suggest Tesla is looking to migrate away from Nvidia and perhaps compete with the chip giant in the future. Moreover, both Amazon and Meta are increasing investments in capital expenditures (capex), specifically in some projects revolving around designing their own in-house semiconductor chips.

Is Nvidia stock a good buy right now?

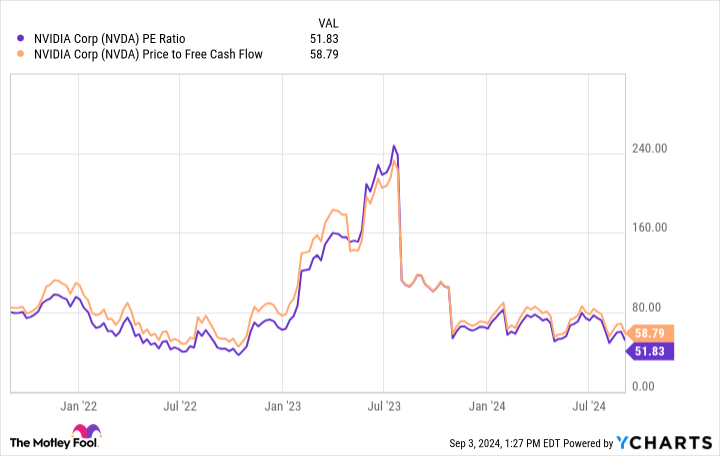

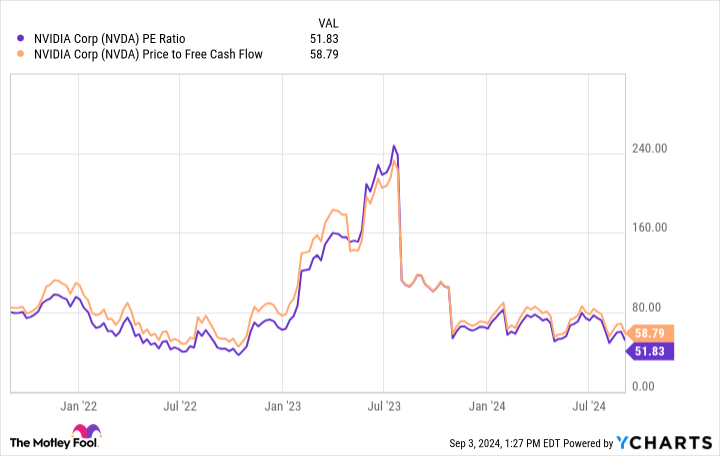

If you look at Nvidia purely from a valuation perspective, there’s an argument to be made that the stock is a bargain right now. On price-to-earnings (P/E) and price-to-free cash flow (P/FCF) bases, Nvidia stock is actually less expensive today than it was even just a few years ago — and that’s with all of this newfound revenue and profit growth.

But I’m beginning to have some concerns that Nvidia is hard-pressed to identify opportunities to allocate capital amid a period of rising competition. I’m not going to put forth the notion that investing in Nvidia is a disastrous choice. I’ll save the doomsday-speak for another time.

However, investors should realize that Nvidia’s record growth across the top and bottom lines will not last forever. Eventually, growth will normalize and take a toll on Nvidia’s profits. For that reason, I find the $50 billion buyback questionable and not reason alone to scoop up shares of Nvidia at the moment.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Opinion: Nvidia’s $50 Billion Buyback Is Not a Reason to Buy the Stock Hand Over Fist. Here’s What I’m Concerned About. was originally published by The Motley Fool