The artificial intelligence revolution has been a mixed bag for software companies. While software stocks that harness the power of large language models (LLMs) have the potential to accelerate revenues, AI also gives software customers the potential to “do-it-yourself.”

For instance, private buy-now-pay-later company Klarna recently announced it would attempt to get rid of its Salesforce and Workday software in lieu of building its own CRM and employee management software internally, through the use of AI.

Yet AI software platform Palantir (NYSE: PLTR) is showing an acceleration in its commercial business due to the advent of AI. And one Wall Street analyst thinks it has much farther to run.

Palantir is no meme stock

Some investors have equated Palantir with the meme stock revolution, leading to doubts about its recent run. This could be due to a few things. First, the stock has a high percentage of retail investors relative to institutional investors. Second, Palantir went public in a direct listing in late 2020, when interest rates were low and many dubious software and technology companies sold shares to the public. Finally, CEO Alex Karp is regarded as some as a quirky and outspoken leader, for better or worse.

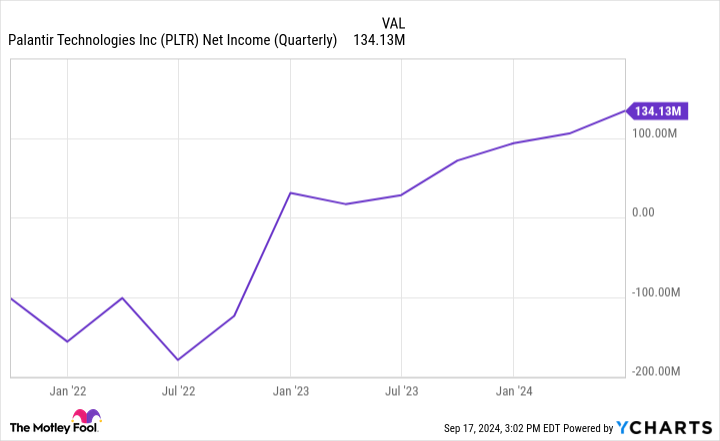

But Palantir is no meme stock. As a proof point, the company was recently admitted to the prestigious S&P 500 index, which has stringent criteria for admission. In the past couple years, Palantir has qualified for the index by posting consistent GAAP profitability — somewhat rare for a software stock.

PLTR Net Income (Quarterly) data by YCharts

AI is leading to a reacceleration in growth

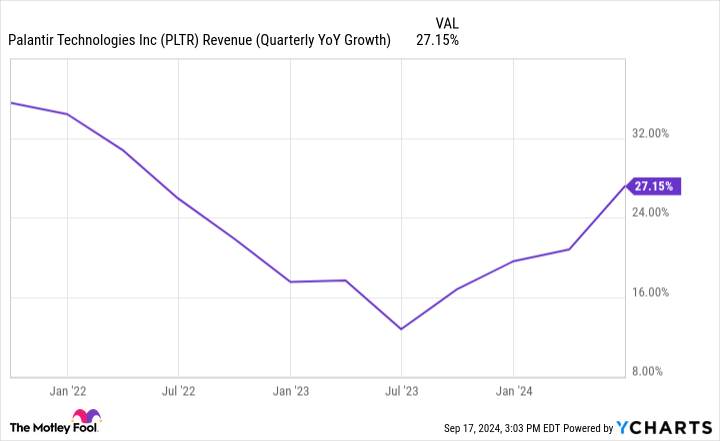

In addition, Palantir has seen its revenue growth accelerate. That acceleration coincided with the introduction of the Palantir Artificial Intelligence Platform, or “AIP,” about a year ago. AIP allows companies to incorporate third-party LLMs or other specialized models directly into Palantir’s existing Gotham or Foundry software platforms.

AIP has invigorated interest in Palantir’s software, especially from commercial customers, resulting in a reacceleration of revenue growth since AIP was introduced.

Normally, it’s harder for companies to increase their growth rate as they get bigger because of the law of large numbers. However, one can see that Palantir has defied this trend. The introduction of AIP and Palantir fine-tuning its marketing strategy to include periodic, “boot camps,” are likely reasons for the inflection. These boot camps allow prospective customers to bring their actual data and experience the AIP in a trial with Palantir’s engineers.

One analyst sees $50 in Palantir’s future

Currently, most of Wall Street is actually bearish on Palantir’s stock. As of August, only six out of 18 analysts rate shares a Buy or Strong Buy, with another six rating shares Neutral and the remaining six rating shares a Sell. The average price target on shares is $27, below the $36 current price as of this writing. This is probably due to Palantir’s stock having more than doubled this year, while currently trading at an expensive valuation of roughly 35 times sales.

But one analyst, Mariana Perez Mora of Bank of America rates shares a Buy, with a street-high $50 price target on the stock. The analyst believes Wall Street misunderstands Palantir, and sees big things in the company’s future, justifying a higher stock price.

Mora thinks others miss how differentiated Palantir is relative to other enterprise software stocks, both product-wise and how Palantir goes to market. Of note, Palantir typically has members of its R&D team embed themselves with a customer first, in order to understand a customer’s business problems and pain points. Then, Palantir tailors its modular software to that business’ specific infrastructure, making its data analytics capabilities more relevant to each individual customer. In its annual report, Palantir notes seeks out “risky and resource-intensive” engagements where other competitors may shy away.

Mora believes this method, which is more difficult upfront and where Palantir doesn’t see immediate revenues, ultimately pays off. This is because the upfront work allows Palantir more pricing power later on. She then sees Palantir’s products spreading to more industries as Palantir rolls out industry-specific platforms, such as the upcoming Warp Speed for manufacturing businesses.

An industry-standard OS like Windows?

Whereas Palantir was formerly known as a specialized software platform for the Defense industry in the War on Terror, Mora sees Palantir becoming an industry-standard platform in the future, calling it, “the common data operational system for the U.S. government and large U.S. businesses.”

If Palantir’s recent acceleration across commercial enterprises continues, she may very well end up being correct. With the majority of revenues still coming from the Defense industry, Palantir’s recent penetration of the much larger enterprise market gives it the chance to keep growth rates high for a while, potentially justifying today’s lofty stock price.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Billy Duberstein and/or his clients have positions in Bank of America. The Motley Fool has positions in and recommends Bank of America, Palantir Technologies, Salesforce, and Workday. The Motley Fool has a disclosure policy.

Palantir Stock Is Skyrocketing. 1 Analyst Thinks It Has Another 38% Gain Ahead. was originally published by The Motley Fool