Share prices of Palantir Technologies (NYSE: PLTR) have approximately doubled so far in 2024. Coincidentally, co-founder and Chairman Peter Thiel recently filed to sell Palantir shares he owns, which are valued at nearly $1 billion. More specifically, the billionaire entrepreneur (who also helped co-found PayPal) has adopted what is referred to as a Rule 10b5-1 plan to sell nearly 28.6 million Palantir shares by the end of 2025.

Thiel appears to be taking this opportunity to lock in the profits these shares have accumulated. The question for investors is: Should they follow suit?

Thiel’s Rule 10b5-1 plan

Before discussing the investment thesis on Palantir, let’s look at what Thiel is doing by implementing a Rule 10b5-1 plan. This rule was designed to help company insiders sell shares in such a way that they won’t be accused of illegal insider trading. Predetermined selling instructions are given by a company insider and then executed by a brokerage. Some of the instructions are made public. Insiders can set parameters for when a stock can be sold, such that it must be at a certain price or just on set dates. They can set it up to sell a set amount of shares or a certain dollar amount.

After the plan is established, there’s a cooling-off period before any trades are made. Changes to the plan can only be made during an open trading window and when the insider has no material non-public information that could impact the stock price. Thiel’s sales will be done through Rivendell 7, which is one of four investment vehicles he owns that holds Palantir stock.

Thiel has set up Rule 10b5-1 plans to sell Palantir stock before. He adopted a plan in December 2023 to sell 20 million shares, which was disclosed in February 2024. His first trade under that plan was for over 7 million shares at an average price of $24.79 on March 12. The plan then enacted a trade of nearly 13 million shares at an average price of $21.11 on May 10. This prior plan had an end date of March 2025 but was finished much sooner.

Thiel currently owns around 99.5 million shares of Palantir through his Rivendell 7, Rivendell 25, PLTR Holdings, and STS Holdings investment vehicles. If the plan is executed, it will reduce his overall holdings in Palantir by close to 29% to 70.9 million shares. At the start of 2024, Thiel owned 148.9 million Palantir shares, so he has been looking to significantly reduce his stake over the next 16 months or so.

Should investors follow Thiel and take profits?

Palantir was trading at around $6 a share when 2023 began, so the stock (now valued at around $35 a share) has been on an incredible run over a relatively short period. Given the stock’s strong performance, it’s perhaps not surprising that Thiel is taking some money off the table. For investors who have large gains in the stock, it certainly can be prudent portfolio management to follow suit and take some gains.

Palantir has proven that it’s a company with great technology that has assisted the government in mission-critical tasks over the years, including fighting terrorism and helping track the spread of COVID-19. Meanwhile, its artificial intelligence (AI) platform is being used by companies across industries with various use cases.

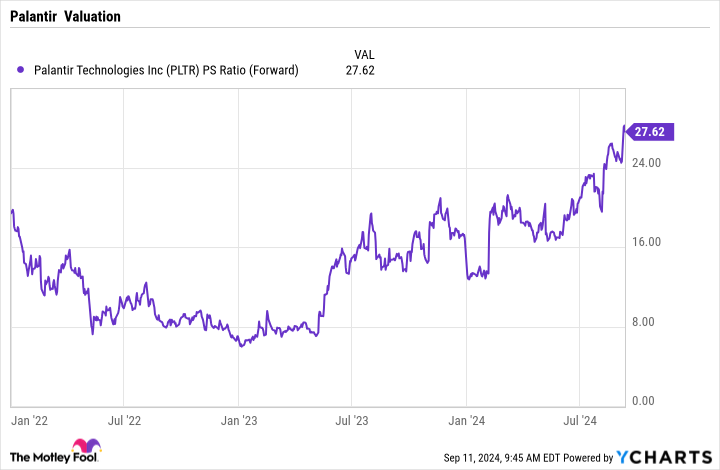

However, the company’s valuation appears to be well ahead of itself at present. After its huge run, the stock now trades at a forward price-to-sales ratio (P/S) of over 27.5 based on analyst estimates for 2024. That’s a huge multiple typically reserved only for companies that are seeing hypergrowth, which Palantir is not.

In fact, Palantir’s government business segment has proven to be a bit lumpy. Last year, government revenue grew just 14%, which held overall revenue growth to just 17%.

Government revenue growth has accelerated, which led to Palantir’s overall revenue growth climbing by 27% year over year last quarter. That’s solid growth but still not the hypergrowth Palantir would need to see to justify its current valuation.

Palantir has the makings of a great company, but at some point, valuation matters. Current investors might want to consider taking a cue from the company’s co-founder and lightening up their positions, locking in some of the profits.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Geoffrey Seiler has positions in PayPal. The Motley Fool has positions in and recommends Palantir Technologies and PayPal. The Motley Fool recommends the following options: short September 2024 $62.50 calls on PayPal. The Motley Fool has a disclosure policy.

Palantir’s Billionaire Chairman Just Filed to Sell $1 Billion in Stock. Should Investors Follow Suit? was originally published by The Motley Fool