A core theme of the economy over the last couple of years is abnormally high inflation. While politicians are often criticized or cheered for the current state of the economy, the Federal Reserve is actually the institution responsible for setting monetary policy.

In an effort to combat inflation, the Federal Reserve raised interest rates 11 times throughout 2022 and 2023. In finance jargon, the “cost” of money is interest. So, essentially, borrowing money becomes more expensive and harder to do when interest rates are increased. The goal here is to tighten money supply — effectively slowing down economic activity. This should (in theory!) bring prices down, resulting in reduced inflation.

Right now, the inflation rate in the U.S. is around 2.9%. While this remains elevated compared to the Fed’s long-term target of 2%, it is a material improvement from the 9% inflation rate from about two years ago. With that in mind, the Fed may finally be ready to start tapering interest rates.

During the Fed’s Economic Symposium a couple of weeks ago, Chairman Jerome Powell strongly alluded that changes to policy are on the way. Candidly, there are only a finite number of things that could mean, and I think rate cuts are coming this month.

Let’s break down one ultra-high-yield dividend stock that I think is poised for newfound growth should rate cuts occur. Now could be a lucrative opportunity to scoop up shares.

How would rate cuts bring some newfound rhythm?

The stock I have on my radar is a real estate investment trust (REIT) called Rithm Capital (NYSE: RITM). The company is an asset manager that focuses on the real estate industry, offering services such as mortgage origination for homes, businesses, and consumers.

As I alluded to above, the cost of borrowing money has become more expensive over the last couple of years. In turn, some areas of economic activity, such as buying a home, doing a home improvement project, or starting a business, have been affected by higher interest rates. Rithm’s business is exposed to these dynamics, leaving its underlying financial trends pretty volatile in parallel with a high-interest-rate environment.

If the Fed does indeed begin to cut rates this month, though, Rithm looks well positioned for some newfound growth. Lowering the cost of capital could inspire greater mortgage refinancing or serve as a tailwind for people looking to buy property. Rithm stands to benefit from these situations, and I think lower rates will ultimately bring some much-needed stability back to the business. But don’t take it from me — Rithm’s CEO is optimistic about the possibility of upcoming rate cuts, too.

During Rithm’s second-quarter earnings call, CEO Michael Nierenberg said: “Looking at the macro picture, we are extremely well-positioned for the future and the expectations, and with the expectations of the Fed lowering rates beginning in September, this bodes very well for our company. This will help lower our borrowing costs and hopefully lead to higher earnings.”

Is now a good time to buy Rithm Capital stock?

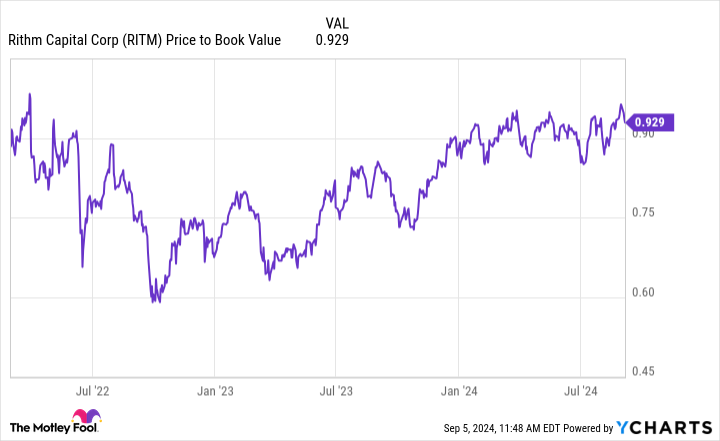

As of the time of this writing, Rithm’s share price of $11.50 is not too far off its 52-week high. The effect of the rising stock price can be easily seen in the chart below, reflecting Rithm’s price-to-book (P/B) ratio. Clearly, the company’s P/B of 0.92 is materially higher than the low points of two years ago. But the choppiness in more recent valuation trends over the last couple of months suggests some mixed investor sentiment.

I think there are a couple of related ideas in play here. For much of 2024, economists all over Wall Street were parroting one another calling for multiple rate cuts. Earlier this year, billionaire hedge fund manager Bill Ackman, among others, suggested the Fed would cut rates multiple times this year. Although that is yet to happen, I think the notion of looming rate cuts inspired some positivity among the investment community, and perhaps influenced some buying activity in companies such as Rithm.

However, the chart shows that Rithm’s P/B has fluctuated frequently throughout the summer. While these moves weren’t overly material, I see the more recent price action as indicative of one thing: Uncertainty. Since the Fed hasn’t tapered rates yet, I think some investors have chosen to sit on the sidelines until something happens (or doesn’t happen).

Given that inflation is consistently showing signs of cooling down, Chairman Powell’s recent remarks, and the outlook from Rithm’s own management, I think there’s a good chance a rate cut will finally occur in September (with more to follow). Should that happen, now could be a great time to pounce on Rithm stock and take advantage of its near-9% dividend yield.

Should you invest $1,000 in Rithm Capital right now?

Before you buy stock in Rithm Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rithm Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Prediction: The Federal Reserve Will Cut Rates In September, and This Ultra-High-Yield Dividend Stock Could Soar was originally published by The Motley Fool