Investors in artificial intelligence (AI) can’t seem to get enough of big tech companies in the “Magnificent Seven.” Even other stocks in the sector such as Super Micro Computer, Broadcom, and Taiwan Semiconductor have started to emerge as more-mainstream choices in the AI realm.

One stock that was once flying high but has since lost altitude during the past several months is computer maker and data-storage company Dell Technologies (NYSE: DELL). The company recently reported earnings for its second quarter of fiscal 2025 (ended Aug. 2). As I’ll break down below, its performance is thriving in some areas while disappointing in others.

The company’s latest earnings report was fine, if not spectacular. But I think investors are souring on Dell too early.

Let’s look at what catalysts the company has to reignite growth. With shares trading at a steep discount to the broader market, now looks like an incredible opportunity to buy the dip hand over fist.

The current state of Dell’s business

Dell bifurcates its business into two categories: infrastructure solutions and client solutions. The infrastructure solutions group (ISG) includes networking and storage services related to servers and data centers, whereas the client solutions group (CSG) is more focused on selling hardware devices to businesses and consumers.

Total revenue for the most recent quarter was $25 billion, up 9% year over year and 13% from the prior quarter. That’s pretty solid!

However, the overwhelming majority of Dell’s growth came from ISG, specifically in networking and server solutions. Revenue from CSG, in contrast, decreased 4%.

Considering that demand for data center services is booming, investors likely expect Dell to generate growth from this part of its business and are therefore uninspired by the prospects of the company’s other segments.

Within the CSG unit, revenue from commercial business was actually little changed year over year. Although that’s not great, it was the consumer side of CSG that was the real drag, declining 22% year over year.

I would caution investors from getting too bogged down in these results, though. Further analysis suggests that both ISG and CSG could be about to shift to a higher gear.

Why Dell’s growth could go parabolic

Many of technology’s most influential businesses — including Microsoft, Meta, Alphabet, Amazon, and Tesla — have all made it clear that more capital expenditures (capex) in AI are very much part of their growth plans. These investments in data centers and chip manufacturing should have a positive impact on Dell’s ISG operation over the long run.

I think Dell’s ISG operation will witness much more acceleration as big tech continues ratcheting up crucial IT architecture.

Another reason I am bullish on Dell is that I see a huge opportunity in client solutions. Both consumer and commercial investments in hardware such as personal computers (PC) are cyclical. But as AI increasingly becomes integrated into more devices, I think both corporations and consumers will need to make upgrades.

During Dell’s second-quarter earnings call, Chief Operating Officer Jeffrey Clarke said the company is “optimistic about the coming PC refresh cycle as the install base continues to age, Windows 10 reaches end-of-life later next year, and the significant advancements in AI-enabled architectures and applications continue.” Clarke pointed to the end of this year and the start of 2025 as the time line when Dell should begin reaping the benefits of this hardware refresh cycle.

Chief Financial Officer Yvonne McGill agreed, saying, “The coming PC refresh cycle and the longer-term impacts of AI will create tailwinds for the PC market.”

To me, both ISG and CSG are well positioned to benefit from ongoing investment in capex — namely in data center and storage solutions as well as upgrading PCs and related devices.

Is now a good time to buy Dell stock?

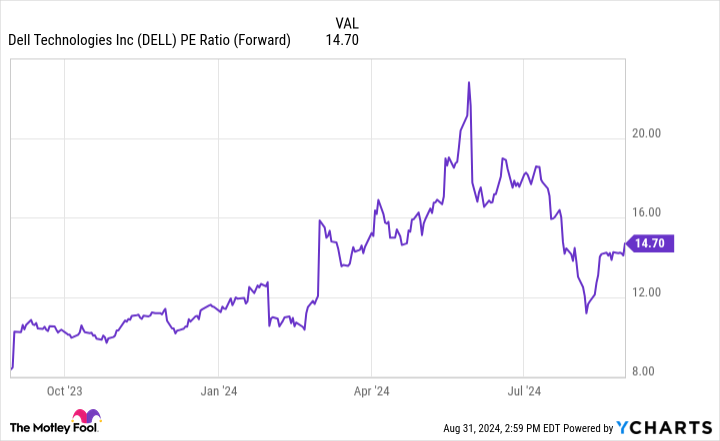

Dell shares have fallen more than 20% during the past three months. This has led to notable valuation contraction, and Dell’s forward price-to-earnings ratio (P/E) of just 14.7 lags the S&P 500‘s forward P/E of 22.4.

I think investors are overlooking Dell’s long-run potential. I wouldn’t expect Dell’s business to show signs of kicking into a higher gear until later this year and into 2025.

But with that said, I think now is a good opportunity to pounce on the depressed shares because gains could very much be in store should Dell’s ISG and CSG demonstrate growth acceleration in coming quarters.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Prediction: This Beaten-Down Artificial Intelligence (AI) Stock Is About to Go Parabolic. Here’s Why. was originally published by The Motley Fool