The Federal Reserve has entered a rate-cutting cycle, the job market is swinging wildly from month to month, and a Presidential election is just on the horizon – it’s a perfect storm to confuse even the savviest investors.

Amid these potentially unsettling factors, Bank of America’s quant strategist Savita Subramanian is advising investors to take the boring choices.

“You want to be in safe dividends,” she says, “and I know this is the most boring call of all time, but sometimes boring is good.”

Dividend stocks, particularly the high-yield payers, bring the advantage of a steady income stream no matter how the markets turn out. Rates go up or down – you cash the dividend check.

Against this backdrop, we’ve used the TipRanks database to look up the latest info on some high-yielding dividend stocks that Wall Street’s top analysts are tagging as buys. For investors seeking high yields, these are solid choices, yielding between 9% to 10%. Let’s give them a closer look.

Redwood Trust (RWT)

Redwood Trust, the first stock we’re looking at here, is a real estate investment trust (REIT), a class of company long known for paying out reliable, high-yield dividends. At its heart, Redwood is a specialty finance company, generating returns by making credit-sensitive investments in mortgage-related assets, including residential loans. The company invests primarily in single-family and multi-family bridge loans (these make up 31% and 25% of the portfolio, respectively), with the third-largest category of investments (11% of the total) being residential jumbo securities. Redwood also acts to provide a source of steady liquidity in the owner-occupied and rental housing markets.

This adds up to a significant business footprint. The company’s portfolio, defined as Redwood’s ‘economic interest,’ totals $3.4 billion, of which 78% is organically created. The remaining 22% is third-party originated. Redwood has been in business, providing homebuyer financing and credit services, since 1994.

On the financial side, Redwood generated $67.5 million in revenues during the second quarter of this year, a figure that was up almost 56% year-over-year. The company’s earnings available for distribution came to 13 cents per share, in line with expectations. The company gave investors a bonus in the last dividend declaration, dated September 11 for the upcoming Q3, with a 6% bump in the common share dividend. The new dividend stood at 17 cents per common share and was paid out on September 30. The 68-cent annualized rate gives a forward yield of 9%.

The increased dividend caught the eye of JMP’s 5-star analyst Steven DeLaney, who expects further dividend increases as we head into next year. DeLaney writes of Redwood’s dividend potential, “Our fresh $0.80 estimate for 2025 is ~8% higher than the $0.74 of total dividends we expect the company to pay next year, while we expect EAD per share to begin covering its current quarterly payout of $0.17 per share (just last month raised from a prior $0.16 payout) in the fourth quarter of this year as the company’s multi-faceted strategies begin to bear fruit, and we have consequently built in a $0.02 increase in the quarterly dividend in the second quarter of next year.”

Drilling down, the JMP analyst also explains why he sees this stock as a sound value, even apart from the dividend, saying of it, “We continue to believe that Redwood’s current stock valuation does not accurately reflect the franchise value of the company’s premier non-agency residential mortgage platform and its flexible and tax-efficient ‘REIT over TRS’ business structure.”

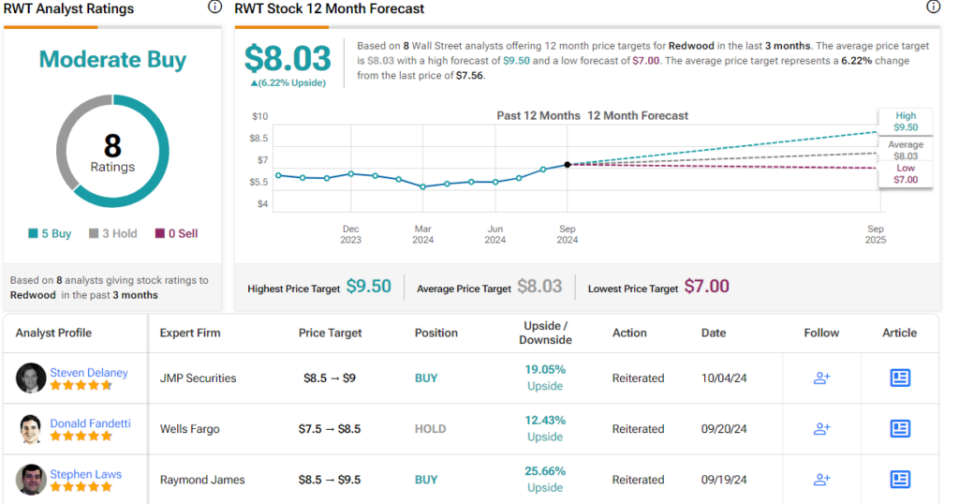

Overall, these comments support DeLaney’s Outperform (Buy) rating on RWT, while his $9 price target implies a one-year upside potential of 19%. Add in the forward dividend yield, and this stock’s total potential return for the coming year reaches 28%. (To watch DeLaney’s track record, click here)

This stock holds a Moderate Buy consensus rating from the Street consensus, based on 8 recent reviews that include 5 to Buy and 3 to Hold. The shares are priced at $7.56 and their $8.03 average price target suggests a gain of 6% in the next 12 months. (See RWT stock forecast)

Blackstone Secured Lending Fund (BXSL)

Next up is a business development company, a BDC. These firms offer capital and credit to private sector companies, especially small and medium-sized enterprises. This class of companies sometimes has difficulty accessing financial services from the traditional banking sector – but it’s vital that they have such access, as they are the chief engine of U.S. economic growth. BDCs like Blackstone Secured Lending Fund fill that gap.

Blackstone Secured Lending Fund operates with sound backing from the larger Blackstone asset manager. With this backing, BXSL has built an investment portfolio worth $11.3 billion at fair value, with investments in 231 companies. The portfolio is overwhelmingly composed of first lien senior secured debt (98.6% of the total) and floating rate debt (98.8%). BXSL focuses mainly on software firms, healthcare providers and service firms, and professional services – these make up 18%, 10%, and 9% of the portfolio, respectively. Commercial services and insurance firms are also represented, at 7% and 6% of the portfolio. BXSL’s total net assets were listed at just under $5.4 billion at the end of 2Q24, the last quarter reported.

In that quarter, the company also brought in a total investment income of $327.06 million, a total that was up 12.6% year-over-year and beat the forecast by $32.48 million. The net investment income came to 89 cents per share, missing expectations by $0.05.

This past August 7, BXSL declared a common dividend of 77 cents per share, for a payout scheduled on October 25. The annualized rate here of $3.08 gives a forward yield of 10.3%.

For RBC analyst Kenneth Lee, rated by TipRanks among the top 1% of the Street’s stock pros, this stock offers investors a combination of proven performance and solid prospects; he says of BXSL, “Credit performance remains strong, with non-accruals still at de minimis levels (0.3% of the portfolio, amortized cost basis)… Given the macro backdrop, we favor BXSL’s conservative risk profile and portfolio construction, and portfolio growth opportunity through BXCI platform benefits. We see total return potential of ~20%, mainly through dividends.”

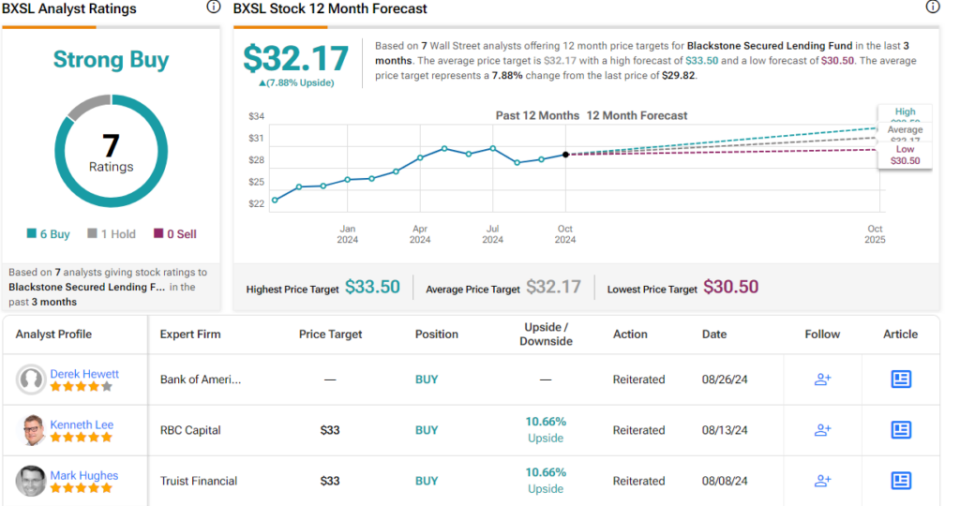

Looking ahead, Lee rates BXSL shares as Outperform (Buy), with a $33 price target that indicates potential for a gain of 10.5% on the one-year horizon. With the dividend yield, the total one-year return here can almost 22%. (To watch Lee’s track record, click here)

This stock’s Strong Buy consensus rating is based on 7 reviews that break down 6 to 1 favoring Buy over Hold. The shares are priced at $29.82 and their $32.17 average target price implies they will gain 8% in the year ahead. (See BXSL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.