Broadcom (NASDAQ: AVGO) stock has stitched together impressive gains of 43% so far in 2024, easily outpacing the 22% gains clocked by the PHLX Semiconductor Sector index this year, and that’s not surprising as the semiconductor giant has been delivering solid quarterly results of late, thanks to the growing demand for its custom chips.

Artificial intelligence (AI) is playing a central role in giving Broadcom’s business a boost. More specifically, Broadcom said in June that it was on track to generate more than $11 billion in revenue this year from sales of AI chips. However, a closer look at the company’s recent quarterly results shows that its AI revenue could end up at stronger levels, which is why investors who haven’t bought this semiconductor stock should consider buying shares before it releases its earnings report on Thursday.

Broadcom stock could stoke investor optimism on Sept. 5

Broadcom will release its fiscal 2024 third-quarter results on Sept. 5 after the markets close. Analysts are expecting $1.20 per share in earnings on revenue of $12.96 billion.

The revenue estimate suggests that the company’s top line is on track to increase 46% year over year, driven to a large extent by the acquisition of VMware which it completed in November 2023.

However, investors should note that Broadcom has beaten Wall Street’s earnings expectations in each of the last four quarters. What’s more, the company raised its fiscal 2024 revenue forecast to $51 billion the last time it reported earnings, from the previous forecast of $50 billion, driven by stronger-than-expected demand for its AI chips.

Broadcom makes custom AI processors, known as application-specific integrated circuits, which are reportedly being deployed by major tech names to train and deploy AI models. At the same time, the company’s networking business has also received an AI-driven boost, with the demand for its ethernet switches rising rapidly to cater to the growing demand for fast connectivity in data centers to support AI workloads.

More specifically, Broadcom’s AI revenue was up an impressive 280% year over year in the previous quarter. There is a good chance of the company being able to sustain that terrific growth, both in the short and the long run.

Harlan Sur of JPMorgan forecasts that Broadcom’s cumulative AI revenue opportunity over the next four to five years stands at a massive $150 billion, which could help the company’s semiconductor revenue increase at an annual rate of 30% to 40%.

Broadcom gets 58% of its revenue from selling semiconductor chips. This business generated $7.2 billion in revenue in fiscal Q2, translating into an annual revenue run rate of almost $29 billion. With $3.1 billion in revenue coming from sales of AI chips in the second quarter, 43% of Broadcom’s semiconductor sales were attributable to this fast-growing technology.

A $150 billion revenue opportunity indicates that Broadcom’s semiconductor revenue is likely to grow big time in the long run. As such, it won’t be surprising to see the company raising its full-year guidance once again when it releases its results on Sept. 5, especially because it has expanded its customer base for custom AI processors and is ramping up production for a third customer this year.

A better-than-expected set of results along with another guidance boost would likely give Broadcom stock a shot in the arm, which is why it may be a good idea to buy it before its upcoming results considering its valuation. It doesn’t make sense to try to time the market and buy to take advantage of just a short-term price jump, but I think the stock is worth holding for years.

The stock looks like an attractive bet based on this forward-looking valuation metric

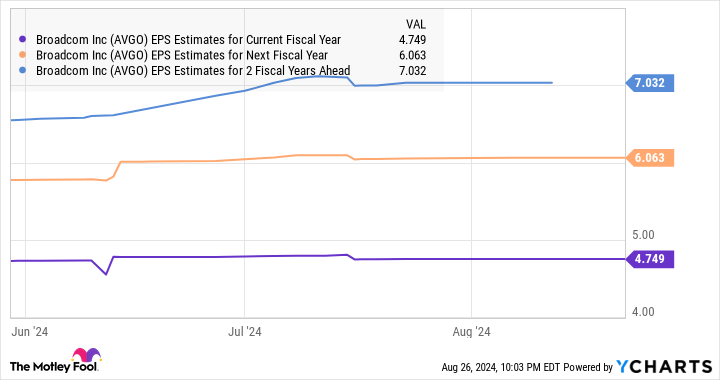

Broadcom’s trailing valuation multiples are expensive. The stock is trading at 17 times sales and 72 times earnings. However, the forward earnings multiple of 27, based on earnings expectations, points toward a big jump in its bottom line. The company is expected to deliver $4.75 per share in earnings this year, which would be a small increase from last year’s level of $4.22 per share. But, as the following chart shows, its bottom-line growth is expected to get better.

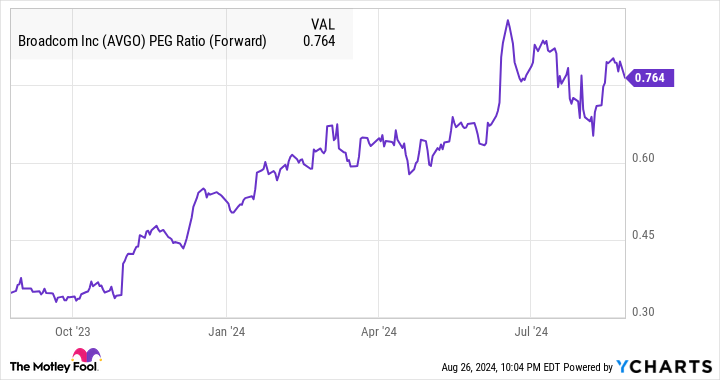

The expected acceleration in Broadcom’s earnings growth explains why the stock is sporting a price/earnings-to-growth ratio (PEG ratio) of 0.76.

The PEG ratio is a forward-looking valuation metric that’s calculated by dividing a company’s earnings multiple by the projected earnings growth it could deliver. A reading of less than 1 is considered to mean that a stock is undervalued in light of the growth it could clock, and the chart above shows that Broadcom is an attractive stock to buy based on its potential growth.

As such, investors looking to add a growth stock to their portfolios would do well to buy Broadcom before its upcoming results — as a strong set of numbers are likely to send its shares higher — and then hold for the long term.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Should You Buy Broadcom Stock Before Sept. 5? was originally published by The Motley Fool