Let’s dig into the relative performance of Plug Power (NASDAQ:PLUG) and its peers as we unravel the now-completed Q2 renewable energy earnings season.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 15 renewable energy stocks we track reported a mixed Q2. As a group, revenues missed analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 9.3% below.

Inflation progressed towards the Fed’s 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut’s timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Amidst this news, renewable energy stocks have had a rough stretch. On average, share prices are down 5.6% since the latest earnings results.

Plug Power (NASDAQ:PLUG)

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power reported revenues of $143.4 million, down 44.9% year on year. This print fell short of analysts’ expectations by 23%. Overall, it was a softer quarter for the company with full-year revenue guidance missing analysts’ expectations.

Plug Power CEO Andy Marsh stated: “The second quarter of 2024 has been pivotal for Plug Power as we continue to make strides in our strategic initiatives and operational capabilities. The addition of Dean Fullerton as COO strengthens our leadership team, and our recent achievements in electrolyzer deployments and partnerships demonstrate our unwavering commitment to advancing the hydrogen economy. We are excited about the opportunities ahead and remain focused on delivering sustainable energy solutions that drive value for our customers and stakeholders.”

Interestingly, the stock is up 2.6% since reporting and currently trades at $2.14.

Read our full report on Plug Power here, it’s free.

Best Q2: Sunrun (NASDAQ:RUN)

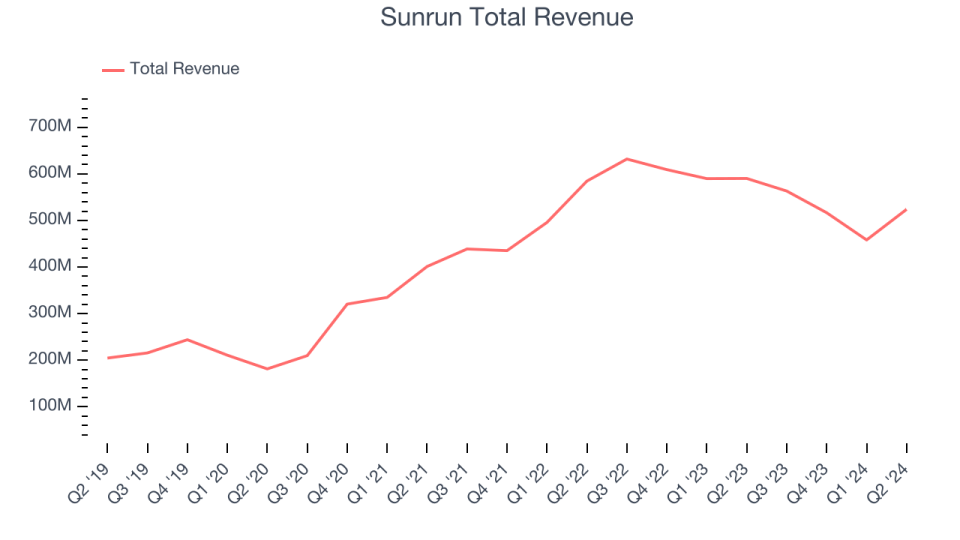

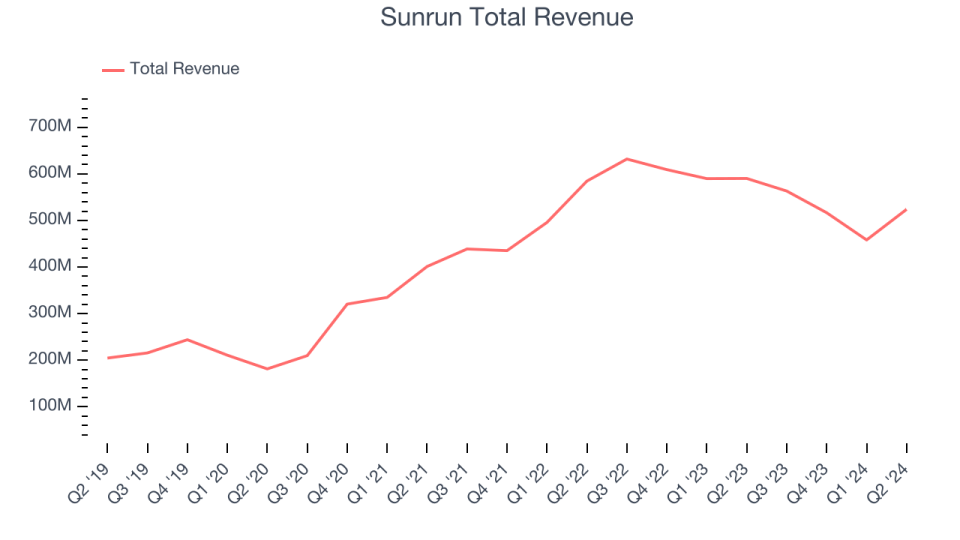

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ:RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun reported revenues of $523.9 million, down 11.2% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with an impressive beat of analysts’ earnings estimates.

The market seems content with the results as the stock is up 2.6% since reporting. It currently trades at $16.88.

Is now the time to buy Sunrun? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Blink Charging (NASDAQ:BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ:BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $33.26 million, up 1.3% year on year, falling short of analysts’ expectations by 14.5%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 34.4% since the results and currently trades at $1.66.

Read our full analysis of Blink Charging’s results here.

FuelCell Energy (NASDAQ:FCEL)

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

FuelCell Energy reported revenues of $23.7 million, down 7.1% year on year. This number surpassed analysts’ expectations by 4.7%. Taking a step back, it was a mixed quarter as it also logged a decent beat of analysts’ earnings estimates but a miss of analysts’ operating margin estimates.

The stock is down 11.6% since reporting and currently trades at $0.36.

Read our full, actionable report on FuelCell Energy here, it’s free.

American Superconductor (NASDAQ:AMSC)

Founded in 1987, American Superconductor (NASDAQ:AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $40.29 million, up 33.2% year on year. This print surpassed analysts’ expectations by 2.4%. It was an exceptional quarter as it also put up revenue guidance for next quarter exceeding analysts’ expectations.

The stock is up 4.5% since reporting and currently trades at $21.51.

Read our full, actionable report on American Superconductor here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.