Shares of Super Micro Computer (NASDAQ: SMCI) are up more than 1,000% in the last three years. The stock is also down 65% from all-time highs.

The data center builder and artificial intelligence (AI) infrastructure accelerator has taken stockholders on a wild ride in recent quarters. Revenue has soared, but there have been concerns about customer attrition and the formation of a potential AI bubble. Recently, there was a short-seller report from Hindenburg Research that drove the stock down even further.

No matter how right or wrong this short report is, the long-term financial fundamentals are what will matter for Supermicro’s stock. Let’s see whether now is a good time to buy the dip, or if you should just cut your losses and sell.

Betting on an AI boom

You could say that Supermicro was at the right place at the right time two years ago. The company is an assembler and designer of large computing clusters, putting together complicated computer chips and things like cooling equipment to make data centers run efficiently. Companies such as Amazon or even Tesla will outsource this and pay Supermicro to be the middleman for data center assembly.

After the rise of ChatGPT and the recent boom in AI infrastructure spending, the company has seen a rise in demand for its services. It is one of the key partners for companies such as Nvidia that sell the computer chips that power these new AI tools. With companies large and small racing to win in AI, speed and efficiency in data center design have been of high importance, which is why companies are turning to Supermicro.

And this strategy has paid off handsomely. Revenue for the fiscal year that ended in June was $15 billion, more than doubling the year-ago last quarter’s figure. Earnings have exploded higher as well. Three years ago, the company barely made any money. Last fiscal year, its operating income topped $1 billion.

When fast revenue growth is a bad sign

One of the biggest mistakes rookie investors make is to extrapolate recent revenue growth in perpetuity. This is what caused investors in Upstart who bought in at the top in 2021 to lose more than 90% of their investment. The company was growing revenue at over 100% year over year a few years ago. Today, its revenue figure is much lower.

As the famous investor Peter Lynch has said time and time again, when analyzing a company, durable growth is more important than just a current high-percentage figure. If revenue growth goes from 100% to flat, the stock will likely do poorly. I think this is a risk for Supermicro.

Before the AI boom, its revenue had gone nowhere for years. This indicates that the recent surge in revenue can almost entirely be attributed to AI spending. Therefore, if AI spending slows, the company’s revenue could easily slow down or even reverse from this $15 billion level.

Semiconductors and data centers are a cyclical market, albeit one that has grown bigger throughout the last few decades. There have been many booms and busts along the way, though.

It is not guaranteed to hit a cyclical peak soon, but investors bullish on Supermicro should be cautious. Just because it is growing sales by 100% year over year doesn’t mean it is automatically a buy.

The stock looks cheap: Is it?

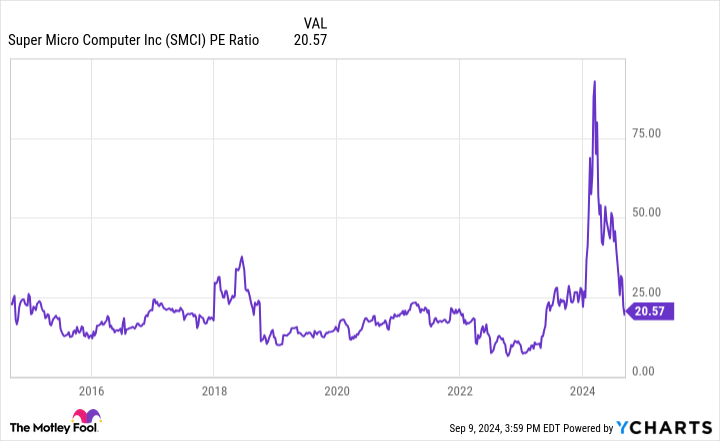

Looking at Supermicro’s price-to-earnings ratio (P/E), the figure is not too demanding. The P/E is 20.5, which is well below the S&P 500 broad market average. What this should tell any investor is that — after this 65% drawdown — the market is not expecting a crazy amount of growth in the coming years.

Believers in the AI boom and continued capital expenditures from the likes of Amazon might like Supermicro stock here. Growth in spending on AI infrastructure probably means the stock does well in the short run.

My concern is the unpredictability of AI spending and the hypercompetitive nature of the industry. After the rabid spending environment of the last few years, does it slow down? Will customers take more of their designs in-house? Will direct competitors such as Dell take customers?

At the end of the day, it is also hard to see why the company has any competitive advantage. All it is doing is assembling computer chips and selling packaged products to customers.

Nvidia is the company actually driving innovation on the hardware side of things, while Meta Platforms, OpenAI, and Amazon are driving innovation on the software side. It is a classic smiling-curve situation, where the middleman doesn’t earn much in profits. This is why Supermicro has an operating margin ofless than 10%.

For these reasons, I think it is best for investors to avoid Super Micro Computer stock even after this downturn. The middleman rarely extracts the profits in situations such as these.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Super Micro Computer Stock Keeps Falling. Should You Buy or Sell? was originally published by The Motley Fool