If you’re looking for a growth stock to help you build wealth for retirement, it’s not enough to just pick a stock of any growing company that is regularly hitting new highs. There are other important qualities you want to look for.

Obviously, you want a company with outstanding growth prospects, but it’s also beneficial to invest in a business that has a loyal base of customers that regularly spend money with the company. This adds resiliency to the business, especially during recessions and bear markets.

One company that immediately comes to mind is Amazon (NASDAQ: AMZN). Here are three reasons why.

1. Repeat revenue from millions of customers

Amazon has millions of retail customers that regularly use their Prime membership to order multiple items every month. Statista estimates the U.S. Prime member count at 167 million, and over 200 million worldwide, with an estimated 42% of U.S. Prime members making between two and four purchases every month. That’s a big reason why Amazon has grown into a massive business with $604 billion in trailing-12-month revenue as of June 30, 2024.

Over the last four quarters, Amazon generated $42 billion from subscriptions and $237 billion from its online store. The company has continued to expand its same-day delivery and grocery delivery to Prime members, which shows the potential to find more ways to increase purchase frequency and grow revenue.

Amazon also generates repeat revenue from its enterprise cloud service. Amazon Web Services (AWS) is the top cloud computing provider in the world, with millions of customers in over 190 countries. AWS contributes less than 20% of Amazon’s total revenue, but importantly, it’s the most profitable business, contributing around two-thirds of the company’s operating profit.

2. Amazon has tremendous growth opportunities

Amazon’s online store and cloud business have a huge market to expand into that can keep the company growing for decades.

The global e-commerce market is set to reach $6 trillion this year, according to eMarketer. It’s expected to reach $8 trillion by 2028, so Amazon has the benefit of chasing a growing market.

As for AWS, the opportunity is even more lucrative for shareholders. Revenue from AWS grew 19% year over year last quarter, reaching $98 billion in trailing-12-month revenue. However, it’s estimated that at least 80% of enterprise data has yet to move from on-premises servers to the cloud.

With that much opportunity, AWS could grow into a very large business one day — potentially Amazon’s largest revenue source. The high margins from cloud services would significantly increase Amazon’s profitability and send the stock higher.

3. The stock has great upside potential

Amazon always looks expensive on the basis of price-to-earnings. That’s because management doesn’t manage the business to maximize earnings per share but to maximize long-term cash flows from operations.

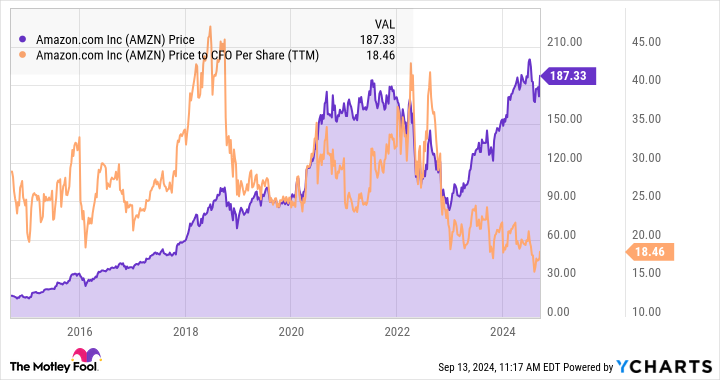

Using Amazon’s cash from operations (CFO) per share, the stock trades at a price-to-CFO multiple of 18.4. Despite the stock doubling in value in the last five years, it is trading at the lowest P/CFO valuation in over 10 years.

Amazon’s cash from operations has tripled in the last five years to $107 billion. In the chart, notice how the stock has soared in value as it followed the growth in the company’s cash from operations, but the shares continue to trade within the same range on a P/CFO basis. With the opportunities Amazon has in e-commerce and cloud services, its cash from operations will continue to grow over time, and that likely means more new highs for the share price.

The stock is currently trading slightly off its recent high of $201, so for an investor that only has a few hundred dollars, now is a great opportunity to buy it.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The Ultimate Growth Stock to Buy With $200 Right Now was originally published by The Motley Fool