The Federal Reserve has officially signaled that interest rate hikes have peaked and that interest rate cuts will begin this year. Since the start of 2022, the Federal Reserve in the United States has increased the interest rate it charges banks, which leads to increasing interest rates paid to customers for banks and savings products.

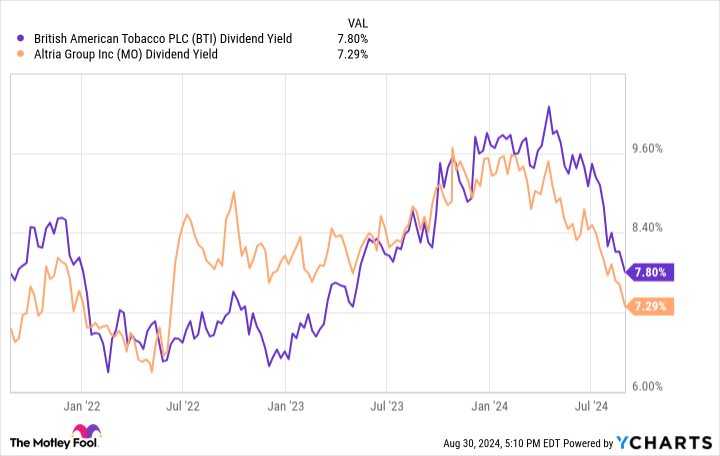

Higher interest rates make slow-growth dividend stocks less attractive, all else equal. The logic goes that if you can get the yield in a savings account, why take the risk with a dividend stock that may fall in value? This is why ultra-high-yielding tobacco stocks British American Tobacco (NYSE: BTI) and Altria Group (NYSE: MO) went nowhere for a few years. This summer, everything changed. Both stocks have soared in the past three months, crushing the returns of the broad market S&P 500 over this time.

Is it too late to buy these two high-yielding tobacco stocks? Or is the party just getting started with interest rates set to decline shortly?

Altria Group: 7.3% dividend yield in a tough customer environment

Altria Group owns the leading premium cigarette brand in the United States: Marlboro. Along with Marlboro, it owns the NJOY nicotine vaping brand, Middleton Cigars, On! nicotine pouches, and a large stake in Anheuser Busch. It currently has a 7.29% dividend yield, down from over 9% earlier this year.

Investors have concerns about declining volumes for Marlboro in the United States. To put it simply, people are smoking less and less in the country. So far this year, Marlboro shipment volumes have declined by more than 10% with no signs of slowing down. They have declined for many years. And yet, Altria’s operating income is up 51.8% in the last 10 years. Why? Because of the pricing power it is able to pass on for cigarette packs. This is a dynamic that can continue for many years.

On top of this, there are a lot of other segments that can drive earnings growth for Altria Group. Cigars are not seeing nearly as quick of a volume decline and also have pricing power. Vaping and nicotine pouches are growth markets and should replace volumes from Marlboro in the coming years. Add it all together, and I think that the concerns about Marlboro’s volume declines are overblown.

Let’s not forget the company’s repurchase program, either. Shares outstanding are down by 13.7% in the last 10 years, which makes it easier for Altria to grow its dividend per share. Free cash flow per share — the fuel for dividend payments — is up 125% in the last 10 years. As long as the company can keep raising prices and transition some consumers to new products while decreasing its share count, I think free cash flow per share can continue to grow.

British American Tobacco: Higher yield and higher upside?

The other ultra-high dividend payer is British American Tobacco. It has some similarities and differences to Altria Group and an even higher dividend yield of 7.8%.

British American Tobacco is similar to Altria in that it has exposure to the fast-declining U.S. market. It owns brands such as Dunhill and Lucky Strike. As discussed above, the company will need to raise prices and improve its profit margin in order to keep profits up in the United States.

Unlike Altria Group, British American Tobacco has exposure to international markets. In general, these markets are seeing slower volume declines compared to the United States, which is a benefit for the company. However, it still has foreign currency risk, which can impact U.S. investors. If the U.S. dollar rises in value relative to other currencies, that can be an earnings headwind to British American Tobacco. The international segment is a mixed bag, but I think it can drive profit growth for many years as long as the U.S. dollar isn’t too strong.

British American Tobacco is doing much better than Altria in new tobacco-free nicotine products. It has strong brands like Vuse (vaping) and Velo (nicotine pouches) that are becoming a much larger part of its business. In fiscal 2023, these smokeless products were 16.5% of revenue and finally flipped from losing money to positive profitability. There is no sign that these divisions are slowing down, either. This can drive cash-flow growth and therefore maintain or grow the British American Tobacco dividend.

Is it too late to buy these dividend payers?

Depending on your tax profile (which can be important for dividend stocks), dividend stocks are great to own if they have a higher yield than a savings account or U.S. Treasury bond. This is especially true if Treasury rates are about to fall. Altria and British American Tobacco both have dividend yields above 7%, which is much higher than what you can get in a savings account.

The only question is: Are the dividend yields safe? I think they clearly are. Both companies are seeing declining volumes in the United States but can counteract these effects with price increases and more profit contributions from new divisions. This is why it shouldn’t be surprising that Altria just raised its quarterly dividend payout by 4% to $1.02.

In fact, I think that both stocks have a good chance to grow their dividend-per-share payouts at a consistent rate over the next five to 10 years. If that happens, income-focused investors will be happy to have bought shares at today’s prices.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

These Ultra-High Dividend Stocks Are Soaring: Is It Too Late to Buy Shares? was originally published by The Motley Fool