Recessions can be scary and have real-world consequences on jobs and the stock market. However, they are a part of life as a long-term investor. Recessions can threaten weak companies that lack the fundamental strength to survive economic downturns.

How do you know a business can survive tough times? Dividends are a great litmus test. Look for companies that can share their earnings with investors and continue increasing that payout through recessions. The U.S. economy has fallen into recession four times since 1990.

Investment management company T. Rowe Price (NASDAQ: TROW) has raised its dividend in all four recessions as well as annually for the last 38 years. Here is the secret behind T. Rowe Price’s longevity and why it could be an excellent buy for any long-term investor today.

A business built on the markets

The financial markets are the core avenue to building wealth in the modern world, but most people don’t have the time, desire, or education to manage all their investments independently. Investment management companies like T. Rowe Price sell various financial products, such as mutual funds, offer advisory services to clients, and operate retirement plans for employers. T. Rowe Price primarily generates revenue by charging fees on the collective $1.6 trillion in assets it manages.

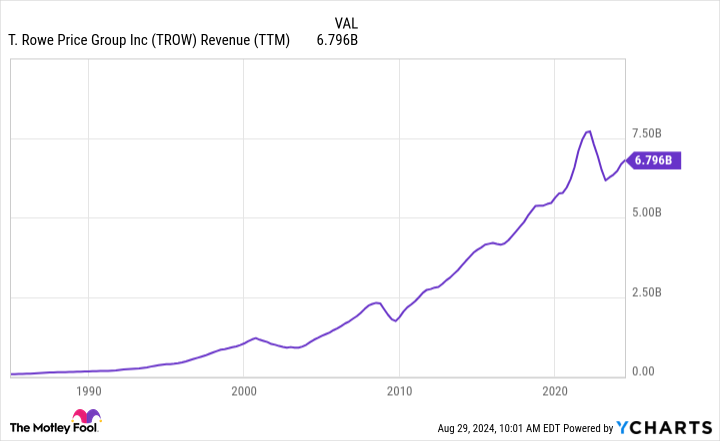

T. Rowe Price’s assets under management (AUM) grow when clients invest more money in its products and services or when the assets themselves appreciate. The U.S. stock market continues to increase over the long term, and that builds growth into T. Rowe Price’s business. However, it also makes the company susceptible to market crashes because asset prices decline, and scared clients might pull their funds out of the markets.

You can see the occasional decline during recessions (2001, 2008, 2020), but the long-term trend points up:

Iron-clad financials support generous shareholder returns

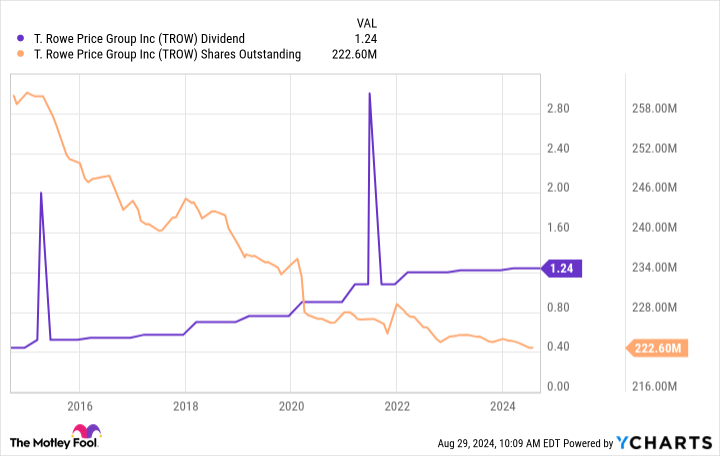

T. Rowe Price gushes cash profits; the company has few expenses besides its employees, which means management can be very generous to shareholders. The company has gone beyond annual dividend raises and paid special dividends twice over the past decade. These are one-time dividends and usually far larger amounts than the typical payout. During that time, T. Rowe Price repurchased 15% of its total shares, which helped boost the stock’s price by increasing earnings per share.

Most importantly, management can do this without sacrificing the company’s financial health. Today, T. Rowe Price has $2.7 billion in cash and zero debt. When the next recession comes, management can supplement any dip in its profits with the cash it already has.

Why T. Rowe Price is a buy today

One risk T. Rowe Price faces is that investors have increasingly moved to passive investment funds over the past decade. T. Rowe Price specializes in actively managed funds that charge higher fees than a passive fund that might follow a market index and charge investors less. This year, total assets in passive investments surpassed active for the first time, which could stunt T. Rowe Price’s long-term growth.

That said, the stock seems priced appropriately for that risk. Shares trade at a forward P/E ratio of 12 today, below its decade average of 15. Analysts believe T. Rowe Price will still grow earnings by almost 7% annually over the long term. Again, the stock’s valuation is pretty reasonable for that expected growth. Even if the stock’s valuation remains the same, investors could still see total annualized returns of around 11% because the dividend yield is 4.6% today.

T. Rowe Price could fall short of growth, and investors are getting a high-yield dividend stock that will likely continue raising its payout. That’s a solid worst-case scenario. On the other hand, the stock could outperform the market if the business delivers as expected. This heads-you-win, tails-you-still-win investment scenario makes the stock a buy today.

Should you invest $1,000 in T. Rowe Price Group right now?

Before you buy stock in T. Rowe Price Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T. Rowe Price Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends T. Rowe Price Group. The Motley Fool has a disclosure policy.

This 4.6% Yielding Finance Stock Raised Its Dividend Through the Past 4 Recessions was originally published by The Motley Fool