The last five years were chaotic, with a global pandemic, a presidential election, inflation, swift interest rate changes, bank failures, and more. Despite this level of economic disruption, the S&P 500 is up nearly 90%. That’s a good run, all things considered.

As good as these broad market returns have been, MercadoLibre (NASDAQ: MELI) stock has left the S&P 500 completely in the dust. Shares of this Latin American business are up over 280% in the last five years.

MercadoLibre is the largest position in my personal Roth IRA, and I’ll explain why in a moment. But first, I want to provide some context to prevent potential misunderstandings.

My Roth IRA is less than five years old. I previously had a retirement account with my employer. I didn’t have control over how that account was invested. But upon changing jobs, I rolled the account over and suddenly had investable cash and decision-making ability.

I quickly diversified the account to over 20 stock positions because diversification is important — it’s a core Motley Fool investing principle. In early 2022, I purchased shares of MercadoLibre for the first time, dollar-cost averaging into my new position until it was worth about 5% of the Roth IRA’s value.

It wasn’t the largest position at the time, but MercadoLibre stock certainly holds that title now. It’s worth far more than 5% of the total portfolio value. However, there are three reasons why I’m not looking to sell any MercadoLibre shares anytime soon.

1. MercadoLibre is poised for growth

Investors can make money in low-growth industries. But it’s way easier to find winning investments by concentrating on leaders in growing markets.

In MercadoLibre’s case, its two main business segments are its e-commerce marketplace and its financial technology (fintech) services. Competition would be far more fierce in North America or Europe. But in its native Latin America, MercadoLibre enjoys a leading position thanks to its early entry into the space.

In terms of market maturity, Latin American markets for e-commerce and digital financial products are younger than those markets in North America, generally speaking. This partly explains why MercadoLibre’s growth has been stellar and why it could remain strong for the foreseeable future.

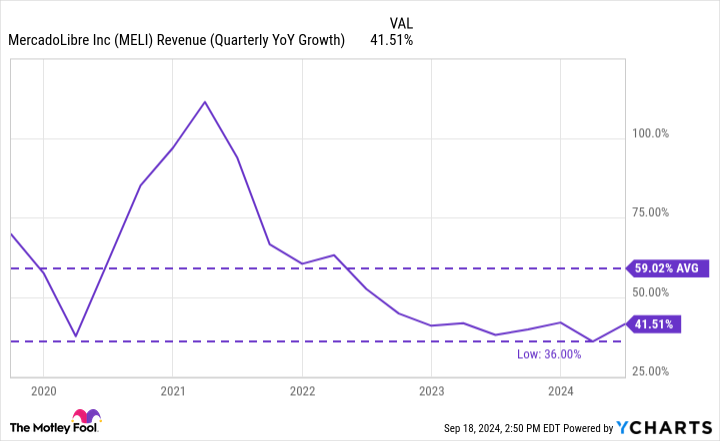

Regarding its growth rate, the chart below shows that MercadoLibre’s slowest growth rate of the last five years was 36% — most companies rarely have a single year of growth that good. And MercadoLibre has averaged top-line growth of nearly 60% across that period. At this rate, the business will quadruple in size every three years, which is just mind-blowing.

I’m not necessarily saying that MercadoLibre will maintain this current pace. But its growth still seems to have plenty of runway, which is the top reason I’m happy that MercadoLibre stock is the largest position in my Roth IRA.

2. MercadoLibre is poised for profits

Many years ago, MercadoLibre decided to sacrifice its good profit margins to invest in shipping and logistics. In its geographies, logistics was the challenge that few companies were solving for. It wasn’t quick, cheap, or easy. But today, MercadoLibre has impressive abilities.

For perspective, over half of orders on MercadoLibre’s e-commerce platform are being delivered same day or next day, which is a rare level of service in the company’s key markets.

Its strength in logistics supports the long-term growth of MercadoLibre’s e-commerce marketplace. Not only are more third-party sellers getting on board (feeding a high-margin revenue stream), but growth of the platform also allows for growth in advertising revenue. The company had around $250 million in ad revenue in the second quarter of 2024, which was up more than 50% year over year.

Moreover, MercadoLibre’s strength in logistics gives it a competitive advantage, and companies with powerful advantages often find ways to improve their margins over time.

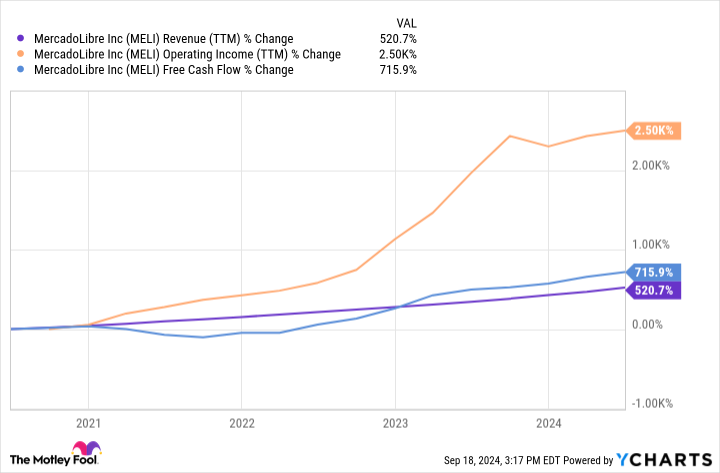

In recent years, MercadoLibre’s revenue growth has been outstanding. But as the chart below shows, growth for profit metrics such as operating income and free cash flow has been even better.

I would expect more gains for MercadoLibre stock if its profits continue to grow as they are now.

3. Letting winners run is a winning strategy

One principle for investing the Motley Fool way is to have a diverse portfolio. Another principle is to let a winning investment continue running, rather than selling it prematurely.

Let’s face it, a diverse portfolio is going to be filled with plenty of bad investments — mine sure is. This can drag down overall long-term returns. However, a single winning stock can do the heavy lifting. But this can only happen if it’s allowed enough time to grow.

There are legitimate reasons to sell a stock. But MercadoLibre’s business is thriving, and it appears to have a long runway. For these reasons, I’ll keep holding my top stock and allow it to lift my portfolio as a whole.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 757% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and MercadoLibre made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 16, 2024

Jon Quast has positions in MercadoLibre. The Motley Fool has positions in and recommends MercadoLibre. The Motley Fool has a disclosure policy.

This Monster Growth Stock Is Up Nearly 300% in 5 Years. Here’s Why It’s the Largest Stock Position in My Portfolio Right Now. was originally published by The Motley Fool