For well over a century, Wall Street has been a wealth-building machine. Although other asset classes have delivered positive nominal returns, including bonds, housing, and various commodities, such as gold, none have come close to matching the annualized total return of stocks, including dividends, over the last century.

While there are thousands of publicly traded companies and exchange-traded funds (ETFs) to choose from, certain investment strategies have, historically, worked better than others. One such approach that’s been documented as a long-term winner is buying and holding time-tested dividend stocks.

Companies that regularly share a percentage of their earnings with investors are almost always profitable on a recurring basis, and they’ve typically demonstrated to Wall Street their ability to navigate challenging economic climates. What’s more, income stocks have a knack for providing transparent long-term growth outlooks. In other words, it’s not a surprise that dividend stocks have, as a whole, increased in value over time.

What may come as a shock is by how much dividend stocks have outperformed non-payers over the long run.

Last year, the investment advisors at Hartford Funds released a report — The Power of Dividends: Past, Present and Future — that compared the performance of income stocks to non-payers over the last half-century (1973-2023), as well as analyzed their relative volatility to the benchmark S&P 500. Whereas non-payers generated a modest 4.27% annualized return and were, on average, 18% more volatile than the S&P 500, dividend stocks delivered a 9.17% annualized return with 6% less volatility than the broad-market index.

Despite the S&P 500 sitting just a stone’s throw from an all-time high, amazing deals can still be found among dividend stocks. As we move forward into September, two electrifying ultra-high-yield dividend stocks — sporting an average yield of 9.02% — are begging to be bought by opportunistic income seekers.

Time to pounce: Enterprise Products Partners (7.16% yield)

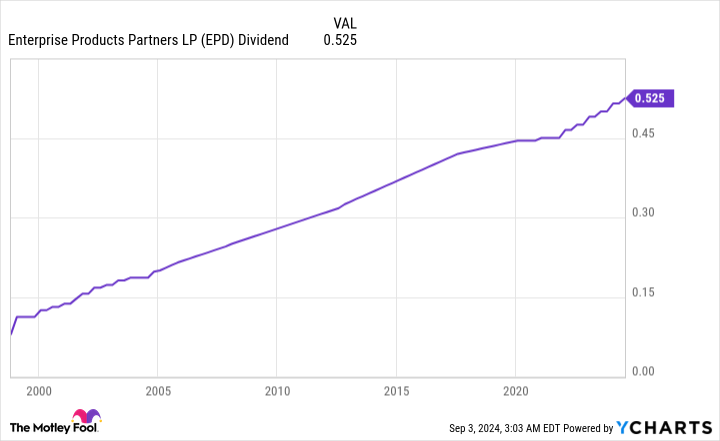

The first high-octane dividend stock that income investors can pounce on with confidence in September is energy juggernaut Enterprise Products Partners (NYSE: EPD). Enterprise has raised its base annual payout for 26 consecutive years.

To be upfront and transparent, investing in the oil and gas industry isn’t for everyone. The memory of the demand cliff for energy commodities that occurred during the COVID-19 pandemic is likely still fresh in the minds of most investors. Thankfully, Enterprise was able to avoid the lion’s share of this operating turmoil, which is what makes it such a solid income-generating investment.

Unlike drillers, which tend to sport high margins but can be easily whipsawed by vacillations in the spot price of crude oil, Enterprise Products Partners is one of America’s largest midstream energy companies. Midstream providers are effectively energy sector middlemen that own and operate pipelines, storage, and fractionation facilities.

The great thing about midstream oil and gas stocks is they tend to produce highly predictable operating cash flow in any economic climate.

Enterprise’s not-so-subtle secret to transparent and predictable operating cash flow is that its signs long-term and predominantly fixed-fee contracts with drilling companies. The “fixed-fee” aspect of these contracts removes the effects of inflation and spot-price volatility from the equation. In turn, this allows Enterprise’s management team to accurately forecast the company’s cash flow multiple quarters, if not years, in advance.

Being able to know ahead of time, with accuracy, how much cash flow Enterprise Products Partners will generate in a given year is critical to management’s decision-making process. For example, it’s given management the confidence to put $6.7 billion to work in various major projects, most of which are tied to increasing its natural gas liquids exposure.

Furthermore, cash flow transparency has fueled Enterprise Products Partners’ bolt-on acquisition strategy. Just two weeks ago, Enterprise announced its intention to acquire Pinion Midstream for $950 million in cash. Pinion is a natural gas gathering and treatment company in the Delaware Basin of New Mexico and Texas. This deal is expected to add $0.03 per unit in distributable cash flow next year.

A multiple of 7.5 times next year’s cash flow, based on Wall Street’s consensus, is a fair price to pay for a company that consistently fires on all cylinders.

Time to pounce: PennantPark Floating Rate Capital (10.88% yield)

A second electrifying ultra-high-yield dividend stock that income-seeking investors should strongly consider pouncing on in September is little-known business development company (BDC) PennantPark Floating Rate Capital (NYSE: PFLT). PennantPark pays its dividend on a monthly basis and its yield is closing in on 11%!

BDCs are businesses that aim to generate income by investing in the equity (common/preferred stock) and/or debt of middle-market companies — i.e., typically small and unproven businesses.

Although it ended June with nearly $209 million of common and preferred stock in its portfolio, the $1.45 billion in debt securities PennantPark Floating Rate Capital holds makes it a decisively debt-focused BDC.

One of the clearest advantages of being a debt-focused BDC for middle-market companies is yield. Unproven businesses usually have limited access to traditional credit markets and basic financial services. When they can access capital, they’re typically going to pay an above-market yield on what they borrow. As of June 30, PennantPark’s $1.45 billion debt-securities portfolio had a weighted-average yield of 12.1%.

Another advantage to this debt-driven investment portfolio is that it’s 100% variable rate. The steepest rate-hiking cycle executed by the Federal Reserve in four decades sent PennantPark’s weighted-average yield on debt investments from 7.4%, as of Sept. 30, 2021, to the 12.1% reported on June 30, 2024. Even with the nation’s central bank expected to kick off a rate-easing cycle later this month, this will be a slow-stepped dropdown in rates. In short, PennantPark’s weighted average yield on debt investments should remain robust.

PennantPark’s management team also deserves a tip of the cap for the ways it’s mitigated risk. Even though PennantPark is investing in smaller, speculative companies, its non-accrual (delinquency) rate in the June-ended quarter amounted to just 1.5% of the cost basis of the company’s portfolio.

Investment diversity is one way the company has avoided trouble. Inclusive of its equity investments, it has roughly $1.66 billion spread across 151 companies, which works out to an average investment size of $11 million. No single investment is large enough to sink the proverbial ship.

Likewise, 99.9% of its debt is held in first-lien secured notes. If one or more of the company’s borrowers were to seek bankruptcy protection, first-lien secured debtholders stand at the front of the line for repayment.

A forward price-to-earnings ratio of 9, coupled with an almost 11% yield, is a recipe for success for patient income seekers.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Sean Williams has positions in PennantPark Floating Rate Capital. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Time to Pounce: 2 Electrifying Ultra-High-Yield Dividend Stocks That Are Begging to Be Bought in September was originally published by The Motley Fool