Fintech card issuer Marqeta (NASDAQ: MQ) went public in the summer of 2021, and the market has mercilessly sold it down ever since. The stock peaked near $33 shortly after its IPO but has drifted as low as $3 and is hanging around $5 today. Investors should be careful about letting price action define the company behind the stock.

Was Marqeta expensive at over $30? Did the stock deserve to trade for a few dollars per share? The truth is usually somewhere in between.

I’ve been a buyer. Marqeta still trades near the low end of its wide range, and the fundamentals are strong enough to suggest the stock is a bargain for long-term investors today.

Here is what you need to know.

The fintech behind modern business models

There is more innovation in business than ever before. Products and services like Buy Now, Pay Later and Instacart weren’t around much longer than a decade ago. Why? Stodgy old financial technologies couldn’t accommodate new business models. Traditional debit and credit payments send money back and forth. Marqeta’s technology opened up new possibilities.

Marqeta is a modern card issuer capable of creating custom payment technologies. When you order on Instacart, a shopper fulfills your order at the grocery store. The company uses Marqeta’s payment technology to match your order to the shopper’s purchases. In other words, it won’t pay for unapproved items, preventing a shopper from fraudulently spending your money. Cryptocurrency fintech Coinbase‘s payment card allows people to pay for items in dollars using the cryptocurrencies in their Coinbase accounts. Marqeta’s technology makes that happen.

Marqeta takes a small fee on every transaction its technology powers. It’s building a recurring revenue tied to the various innovative and fast-growing companies it serves.

Why Wall Street has sold the stock

The company did face some issues. Block (NYSE: SQ), Marqeta’s largest customer, renewed their relationship last year in a four-year contract that included a 40% lower take rate. That negatively impacted Marqeta’s growth.

Additionally, the company’s founder, Jason Gardner, left. He resigned as CEO in August 2022 and then from the board as Executive Chairman in June 2024. It’s never ideal to see a founder leave a company when the business is young.

Lastly, the investing climate shifted as near zero-percent interest rates disappeared and aggressive rate hikes over a short time frame slowed the overheated economy. That dumped water on the market’s appetite for riskier investments. This downward pressure, new Block deal terms, and a management shakeup help explain the stock’s misfortunes.

Here is the long-term investment pitch

There are several reasons why investors should see a much brighter future with Marqeta moving forward.

First, the Block renewal paints an overly negative picture of Marqeta’s business momentum. Marqeta conceded a lower take rate, but the deal wasn’t all bad. Previously, Marqeta would front interchange, network, and bank fees for the Cash App business and then charge Block for them. Now, Marqeta is passing those along directly to Block. The result is lower stated revenue, but gross profit remains intact aside from the lower take rate.

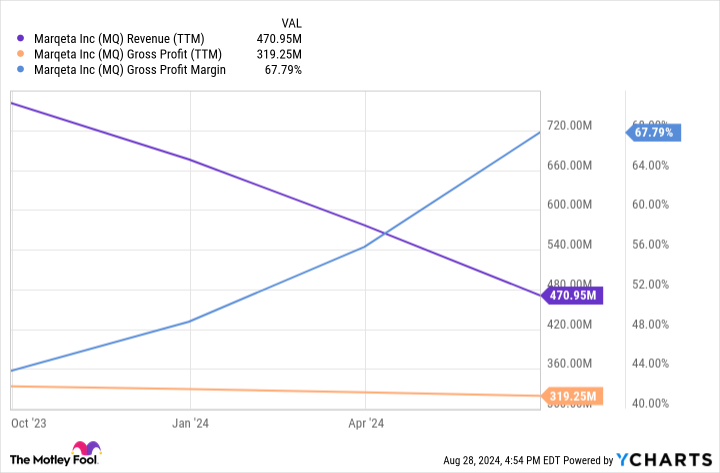

You can see the impact of these changes below:

It looks like Marqeta’s business is collapsing, but its payment volume continues to grow rapidly. In Q2, the company’s payment volume grew 32% year over year despite reported revenue declining 46%. The good news is that Q2 was the last quarter compared to pre-Block renewal financials, meaning Q3 and beyond will more accurately reflect the company’s growth.

Next, Marqeta is slowly diversifying its business from Block. While net revenue from Block was still 47% of Marqeta’s total in Q2, that’s down from 71% at the end of 2022. Management noted that non-Block revenue growth accelerated by over 10 percentage points in Q2, a healthy sign for the business. The new Block contract goes until 2027. The more it can diversify away from Block between now and then, the more predictable Marqeta’s future revenue becomes.

Lastly, the aggressive selling is arguably overdone at this point. Marqeta is working through some things, but this company is financially stable. Marqeta currently has $1.1 billion in cash against almost zero debt on its balance sheet. The company isn’t generally accepted accounting principles (GAAP) profitable yet but it generates positive free cash flow. That gives the company flexibility to invest in growth while it works toward positive net earnings. The stock’s market cap is only $2.7 billion, meaning more than 40% of the stock’s value is in cash!

The change in interest rates and restated revenues make quantifying the stock’s value difficult. However, sentiment couldn’t be much lower than it is now. Again, this stock is more than 40% cash.

Marqeta’s stock could perform very well once investors start to get a better picture of the company’s underlying growth in Q3.

Should you invest $1,000 in Marqeta right now?

Before you buy stock in Marqeta, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Marqeta wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Justin Pope has positions in Marqeta. The Motley Fool has positions in and recommends Block and Coinbase Global. The Motley Fool recommends Instacart and Marqeta. The Motley Fool has a disclosure policy.

Wall Street May Be Selling This Fintech Stock, but I’m Buying. Here’s Why was originally published by The Motley Fool