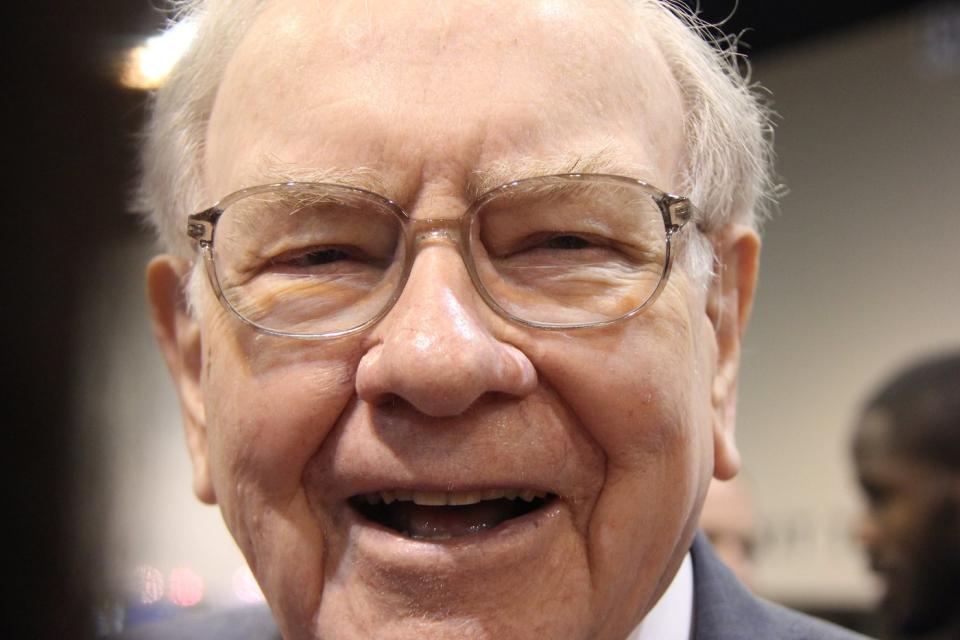

Few investors receive as much attention on Wall Street as Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett. This is because the Oracle of Omaha has lapped Wall Street’s benchmark index, the S&P 500, many times over.

Since taking the reins at Berkshire in the mid-1960s, Buffett has overseen an aggregate return in his company’s Class A shares of more than 5,400,000%. Comparatively, the S&P 500 has increased in value, including dividends, by around 37,000% over the same span.

Buffett’s well-publicized recipe for success has involved buying stakes in time-tested businesses that offer clear-cut competitive advantages and strong management teams. Most importantly, he looks to the horizon when investing and tends to hold on to positions in Berkshire Hathaway’s portfolio for years, if not decades, at a time.

But the Oracle of Omaha is also a big-time believer in portfolio concentration. This is to say that his best ideas are deserving of outsize investment capital.

While mirroring Buffett’s investment activity has, for decades, been a moneymaking strategy, investors will have to do some unconventional digging to locate his favorite stock to buy.

Warren Buffett has been a very selective buyer of stocks for nearly two years

No later than 45 calendar days following the end to a quarter, institutional investors with at least $100 million in assets under management are required to file Form 13F with the Securities and Exchange Commission. A 13F provides an easy-to-understand snapshot of which stocks, industries, sectors, and trends Wall Street’s best money managers bought into and sold out of in the latest quarter.

Warren Buffett’s 13Fs for the last seven quarters (Oct. 1, 2022 to June 30, 2024) show that he and his top investment aides, Ted Weschler and Todd Combs, have been unabashed sellers, with net stock sales totaling close to $132 billion. With Berkshire’s chief sending roughly $7.2 billion worth of Bank of America stock to the chopping block since July 17, it looks to be on pace for an eighth straight quarter of net equity sales.

However, Form 13Fs have highlighted small pockets of selective buying activity. For instance, Buffett can’t seem to get enough of integrated energy company Occidental Petroleum (NYSE: OXY). Since the start of 2022, more than 255.2 million shares of Occidental have been purchased.

Although a higher spot price for crude oil tends to be great news for all drillers, Occidental is especially levered to its drilling segment. While its downstream chemical plants can somewhat hedge downside in the spot price of oil, it relies heavily on elevated oil prices to drive operating cash flow from its upstream drilling operations.

Buffett has also been a willing buyer of property and casualty insurer Chubb (NYSE: CB). Chubb is the company that was revealed in mid-May as the “confidential” stock that Berkshire had been building a position in since the third quarter of 2023.

Though the insurance business tends to be boring, it’s also highly profitable. When catastrophe losses inevitably occur, insurers have a tangible reason to raise premiums on their customers. But even when payouts are on the low end, insurers like Chubb maintain exceptional premium pricing power given that loss claims and catastrophe events are normal occurrences over the long run.

Unfortunately, Berkshire Hathaway’s quarterly Form 13Fs fail to tell the full story about Buffett’s favorite stock to buy.

The Oracle of Omaha has put almost $78 billion to work in a stock near and dear to his heart

Despite holding $13 billion worth of Occidental stock, and nearing $8 billion in Chubb, neither of these holdings are Buffett’s most beloved stock.

This “favorite stock” is a company the Oracle of Omaha has purchased shares of for 24 consecutive quarters (a span of six years), as of June 30, 2024, and has sunk nearly $78 billion worth of his company’s cash into.

To demonstrate just how much conviction Buffett has in his favorite stock, compare this close to $78 billion investment to the 500 companies that comprise the broad-based S&P 500. As of the closing bell on Sept. 13, 379 S&P 500 companies had a lower market cap than the amount of money Buffett has put to work in the stock nearest and dearest to his heart over the last six years. In theory, Buffett could have outright purchased Chipotle Mexican Grill, FedEx, or Target, but chose to plow almost $78 billion into one stock.

The twist is that Buffett’s favorite stock to buy is… shares of his own company.

A 13F isn’t going to detail share repurchase activity. Rather, investors can usually find Berkshire Hathaway’s buyback activity highlighted just prior to the executive certifications page in every quarterly report.

Prior to July 2018, Buffett was only allowed to buy back stock if his company’s shares fell to or below 120% of their book value. Since shares never fell below this threshold, no buybacks were undertaken.

On July 17, 2018, Berkshire Hathaway’s board amended the rules governing buybacks to allow Buffett to work his magic. The new criteria states that buybacks can continue with no end date or ceiling as long as:

-

Berkshire has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet; and

-

Warren Buffett believes shares are intrinsically cheap.

This second point is wide open to interpretation, leaving Buffett with ample room to pull the trigger on buybacks whenever he sees fit. With Berkshire’s cash pile ballooning to an all-time record of $276.9 billion, as of the end of June, Buffett has more than enough firepower to continue repurchasing shares of his own company. The $345 million used for repurchases in the June-ended quarter increased total buybacks since this amendment in July 2018 to almost $78 billion.

One of the key reasons the Oracle of Omaha is such a big fan of buybacks is because they incentivize long-term investing by incrementally increasing the ownership stakes of patient investors. As the outstanding share count declines, each remaining share holds a fractionally larger stake in the company.

Furthermore, buybacks have a way of making most time-tested businesses more fundamentally attractive to investors. Businesses with steady or growing net income, such as Berkshire (sans unrealized investment gains/losses), should see their earnings per share (EPS) expand over time as the company’s share count decreases.

While Buffett might be bullish on Occidental Petroleum and Chubb, no other company can hold a candle to his most beloved stock, Berkshire Hathaway.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Chipotle Mexican Grill, FedEx, and Target. The Motley Fool recommends Occidental Petroleum and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Warren Buffett Could Have Bought Any of 379 S&P 500 Companies With Nearly $78 Billion. Instead, He Piled It All Into His Favorite Stock. was originally published by The Motley Fool