For the better part of six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been one of Wall Street’s most-revered investors. Overseeing a cumulative return of more than 5,650,000% in Berkshire’s Class A shares (BRK.A) since becoming CEO has earned Buffett quite the following, as well as the nickname, “Oracle of Omaha.”

Professional and everyday investors frequently await Berkshire Hathaway’s quarterly Form 13F filing to gain an idea of which sectors, industries, trends, and stocks Buffett and his top lieutenants, Todd Combs and Ted Weschler, bought into and sold out of in the latest quarter.

But sometimes Berkshire’s quarterly operating results, or Form 4 filings with the Securities and Exchange Commission, can tell a more thorough story — even if it’s an unpleasant one.

Warren Buffett has been a net-seller of equities for the last two years

Arguably the best thing about Warren Buffett is that he’s usually an open book. Though there have been a couple of occasions where he and his team have built up a sizable position in a stock using confidential treatment — insurer Chubb is the latest example — Buffett has typically been upfront about his thoughts on the U.S. economy and stock market.

On more than one occasion, the Oracle of Omaha has cautioned investors not to bet against America. Though Buffett, Combs, and Weschler are fully aware that recessions are perfectly normal and inevitable, they also realize that periods of economic growth and bull markets last substantially longer than recessions and bear markets.

Despite this stance, what Warren Buffett does over shorter timelines doesn’t always line up with the long-term ethos that former right-hand man Charlie Munger and he instilled at Berkshire Hathaway. Munger passed away at age 99 in late November.

Recently, Buffett has been a somewhat aggressive seller of Bank of America (NYSE: BAC) stock. Between July 17 and Aug. 30, Berkshire’s stake in BofA has declined by about 150 million shares, equating to roughly $5.4 billion.

This $5.4 billion in selling activity is a pretty clear warning to Wall Street and investors.

To begin with, there’s not a sector Buffett loves to invest in more than financials, and arguably not a financial stock that he’s favored more over the last seven years than Bank of America. BofA’s interest rate sensitivity, coupled with CEO Brian Moynihan’s desire to reward his company’s shareholders with a robust capital return program (dividends and share buybacks), has made Buffett a happy camper.

The fact that Buffett has dumped nearly 15% of his company’s stake in Bank of America in a span of just over six weeks suggests clear worry about the U.S. economy and stock market. Like pretty much all bank stocks, BofA is cyclical.

The other issue is it puts Berkshire Hathaway on track for its eighth consecutive quarter of selling more securities than it’s purchased.

Collectively, Warren Buffett has overseen $131.6 billion more in securities sold than purchased between Oct 1, 2022 and June 30, 2024.

The logical explanation for this is that stocks are historically pricey and Buffett wants no part of the “casino.”

The stock market is historically pricey

To reiterate, Warren Buffett suggests investors not bet against America. You’ll never see Buffett or his team purchase put options or short-sell securities.

Nevertheless, being a long-term optimist and expecting the U.S. economy to grow over time doesn’t mean the Oracle of Omaha is going to pay an exorbitant premium for stocks. If a “fair price” can’t be had for wonderful companies, Buffett will sit on his hands for as long as necessary until a fair price is reached or plain-as-day price dislocations occur.

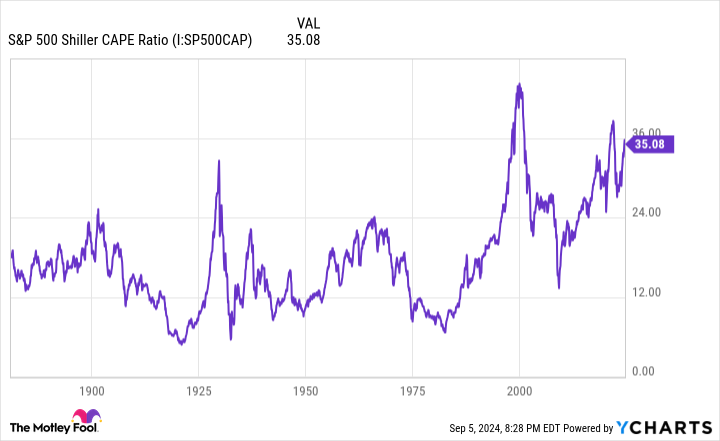

Based on the S&P 500‘s (SNPINDEX: ^GSPC) Shiller price-to-earnings (P/E) ratio, which is also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio), stocks have only been collectively pricier during two other bull markets over the last 153 years.

Whereas the traditional P/E ratio examines a company’s trailing-12-month earnings per share (EPS) relative to its share price, the S&P 500’s Shiller P/E takes into account 10 years of inflation-adjusted EPS. The advantage of the latter is that it smooths out the impact of one-off events and shocks, thereby providing a more accurate valuation measure.

When back-tested to January 1871, the S&P 500’s Shiller P/E has ranged from a low of 4.78 in December 1920 to a peak of 44.19 during the dot-com boom in December 1999. As of the closing bell on Sept. 5, the Shiller P/E stood at 35.38, which is more than double its 153-year average of 17.16.

The bigger concern is what’s happened the previous five instances where the S&P 500’s Shiller P/E surpassed 30 throughout history. Although the Shiller P/E isn’t a timing tool, hindsight shows that the S&P 500 and/or Dow Jones Industrial Average have plunged between 20% and 89% following each prior instance where stock valuations were extended.

In other words, it’s just a matter of before investment euphoria fades and traditional valuation metrics come back into focus. Based on what history tells us, this will occur sooner, rather than later.

Buffett’s best buys often occur during periods of panic

Selling almost $132 billion more in securities than have been purchased since the start of October 2022 has increased Berkshire Hathaway’s cash pile — this includes cash, cash equivalents, and U.S. Treasuries — to an all-time high of $276.9 billion. Chances are good that this cash hoard will grow even more in the current quarter given the persistent selling we’ve witnessed in shares of Bank of America.

While this $5.4 billion warning is a very clear indication from Buffett that stock market and/or economic turbulence is expected, it’s precisely what the Oracle of Omaha hopes for with such a massive treasure chest at his disposal.

One virtual guarantee is that Warren Buffett will continue to purchase shares of his favorite stock, Berkshire Hathaway. Over 24 consecutive quarters (i.e., six years), he’s overseen the repurchase of nearly $78 billion worth of his company’s stock.

But the bigger story is what price dislocation will attract Buffett next. Following the financial crisis, Buffett invested $5 billion into Bank of America preferred stock. This helped to shore up BofA’s balance sheet at a time when banks were Wall Street’s chopped liver. More importantly, it gave Buffett access to warrants entitling him the right to buy 700 million shares of BofA stock at $7.14 per share, which he did for Berkshire Hathaway in mid-2017.

Periods of emotion-driven selling, while brief, have historically been Warren Buffett’s time to shine. With stocks at one of their priciest valuations in history, Buffett’s selling activity foreshadows both the peril and promise of what’s to come.

Should you invest $1,000 in Bank of America right now?

Before you buy stock in Bank of America, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett’s $5.4 Billion Warning to Wall Street Foreshadows Trouble to Come was originally published by The Motley Fool