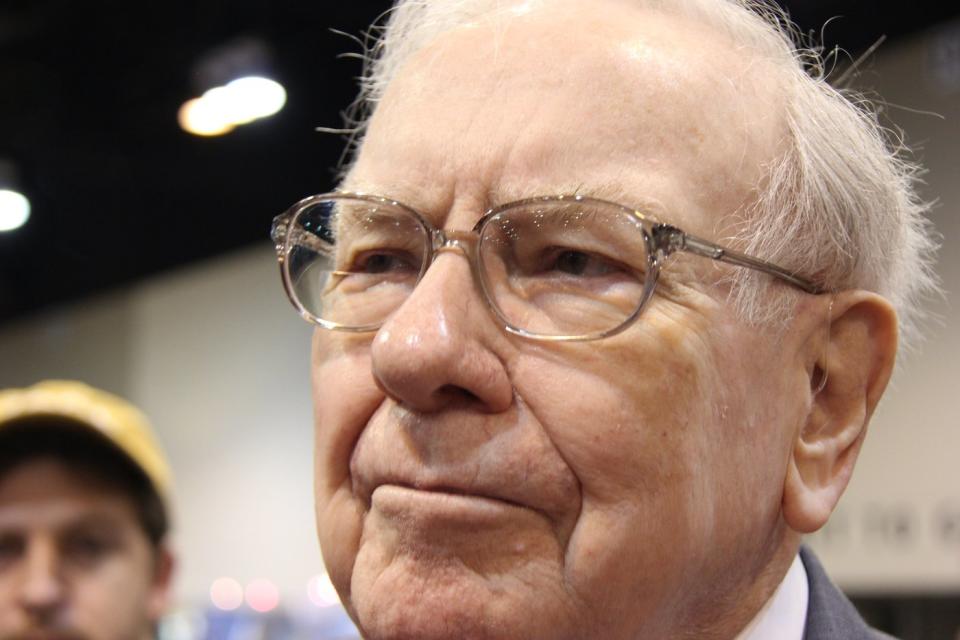

Few if any money managers command the attention of professional and everyday investors quite like Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett. Since becoming CEO in the mid-1960s, he’s overseen a cumulative return in his company’s Class A shares (BRK.A) of more than 5,500,000%, and briefly witnessed his company surpass a $1 trillion market cap.

Investors often wait on pins and needles for the quarterly release of Berkshire’s Form 13F. A 13F provides investors with a concise snapshot of what Wall Street’s brightest money managers purchased and sold in the latest quarter.

But here’s something that might come as a bit of a surprise: Berkshire Hathaway’s 13F fails to tell the full story of what’s under the company’s hood.

The Oracle of Omaha has a secret $602 million portfolio, and three AI stocks are getting the heave-ho

In 1998, Berkshire Hathaway acquired General Re in an all-share deal valued at $22 billion. Although the crown jewel of this deal was General Re’s reinsurance operations, it also owned a specialty investment firm known as New England Asset Management (NEAM). When the deal finalized in December 1998, Buffett became the new owner of NEAM.

Institutional investors with at least $100 million in assets under management are required to file a 13F with the Securities and Exchange Commission. As of the June-ended quarter, New England Asset Management held $602 million in securities, and is therefore required to disclose what stocks have been bought and sold.

Even though Warren Buffett doesn’t manage the assets held by NEAM the same way he does for the 43-stock, $309 billion portfolio he oversees at Berkshire Hathaway, what NEAM owns is, ultimately, under the umbrella of Buffett’s company. Thus, New England Asset Management is, effectively, Warren Buffett’s $602 million secret portfolio.

Similar to Buffett’s trading activity over the last two years, the advisors overseeing NEAM’s portfolio have predominantly been net-sellers of equities. What was once a portfolio that boasted $6.3 billion of assets, as of the March-ended quarter in 2022, now holds “just” $602 million in securities, as of June 30, 2024.

Most notably, Buffett’s secret portfolio has been dumping its holdings in three high-growth artificial intelligence (AI) stocks — and no, Nvidia isn’t one of them.

Broadcom

The first high-flying AI stock that’s being given the heave-ho by the asset managers of Buffett’s hidden portfolio is networking solutions specialist Broadcom (NASDAQ: AVGO). New England Asset Management reduced its stake in the company by 19% in the June-ended quarter.

There’s no denying that Broadcom has been a clear beneficiary of the rise of AI. Its networking solutions, which are designed to reduce tail latency and maximize the computing potential of AI-graphics processing units (GPUs), have quickly become staples in enterprise data centers tasked with running generative AI solutions and training large language models.

But what investors, including those at NEAM, might be overlooking is that Broadcom is much more than just an AI networking solutions provider. For instance, it’s one of the leading wireless chip and accessory providers for next-generation smartphones. Wireless carriers upgrading their networks to support 5G download speeds has led to a sustained device replacement cycle that’s clearly benefiting Broadcom.

Broadcom is also a key supplier of optical components used in automated industrial equipment, networking solutions for next-gen vehicles, and cybersecurity solutions.

I’d be remiss if I didn’t also mention that Broadcom occasionally leans on acquisitions to expand its product and service ecosystem and improve cross-selling opportunities. Its latest acquisition — a $69 billion deal to buy cloud-based virtualization software company VMware, which closed last year — should help it become a key player in private and hybrid enterprise clouds.

The only logical reason to sell shares of Broadcom is if you believe the AI bubble is going to burst — and there are plenty of signs to suggest this could happen. While an AI bubble-bursting event would, undoubtedly, hurt Broadcom’s stock, its business is well-diversified and able to navigate whatever is thrown its way.

Microsoft

A second AI stock that the money managers of Warren Buffett’s $602 million secret portfolio appear to be souring on is the second-largest publicly traded company, Microsoft (NASDAQ: MSFT). During the second quarter, a hair over 20% of NEAM’s stake in Microsoft was shown the door.

Microsoft is integrating AI into a variety of its operating segments. This includes offering generative AI solutions to its Azure clients. Azure is the world’s No. 2 cloud infrastructure service platform and has consistently been Microsoft’s fastest-growing operating segment. With most businesses still early in their cloud-spending cycle, Azure can likely be counted on for sustained double-digit sales growth.

Microsoft has also been inorganically investing in the AI revolution. For instance, it’s a core investor in OpenAI, the company behind popular chatbot ChatGPT. OpenAI assisted Microsoft in relaunching its Bing search engine and Edge browser with AI capabilities.

Further, Microsoft and BlackRock announced plans last week to launch a $30 billion fund that’ll invest in various AI infrastructure. Microsoft is flush with cash, and its management team has demonstrated a willingness to expand its product and service ecosystem by putting it to work.

So, why sell a fifth of NEAM’s Microsoft stake if the company is firing on all cylinders? The answer probably lies with Microsoft’s valuation.

As of the closing bell on Sept. 17, Microsoft was valued at nearly 32 times consensus earnings per share for fiscal 2026 (ended June 30, 2026). This is about 7% higher than its average forward price-to-earnings (P/E) multiple over the trailing-five-year period, and is a somewhat aggressive earnings multiple given how pricey the stock market is right now.

Alphabet

The third artificial intelligence stock in Buffett’s $602 million secret portfolio that’s been sent to the chopping block is Google parent Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG). Specifically, the managers at NEAM sold nearly 28% of their fund’s stake in Alphabet’s Class A shares (GOOGL) in the second quarter.

Similar to Microsoft, Alphabet should see a lot of its AI-related growth stem from generative AI solution integration with its cloud infrastructure service platform.

Google Cloud is the world’s No. 3 cloud infrastructure service platform by total spending, and it became profitable on a recurring basis last year. Since the margins associated with cloud services are usually much higher than advertising margins, Google Cloud has a chance to be Alphabet’s primary driver of operating cash flow by the turn of the decade.

For the time being, Alphabet’s foundational operating segment continues to be its Google search engine. For more than nine years, Google has accounted for no less than 90% of the monthly share of global internet search. This makes it the clear go-to for advertisers and affords Alphabet phenomenal ad-pricing power.

Furthermore, Alphabet is sitting on almost $111 billion in cash, cash equivalents, and marketable securities. Similar to Microsoft, Alphabet’s balance sheet gives it a level of financial flexibility that few companies can match.

Given that Alphabet is historically cheap, NEAM’s selling of Alphabet stock is a bit of a head-scratcher. The best guesses as to why Buffett’s secret portfolio is dumping shares of Alphabet is the growing likelihood of the AI bubble bursting and stocks, as a whole, being expensive.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Berkshire Hathaway, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Warren Buffett’s Secret Portfolio Is Dumping Shares of 3 Supercharged Artificial Intelligence (AI) Stocks (No, Not Nvidia!) was originally published by The Motley Fool