Chipotle Mexican Grill‘s (NYSE: CMG) stock has been a strong performer over the past five years — it’s up about 250% during that stretch. However, now that its former CEO, Brian Niccol, has left to take the helm of Starbucks, many investors are wondering where Chipotle and the stock may be headed over the next five years.

Future valuations are typically dependent on two main things: growth and valuation multiples. With that in mind, let’s take a look at the company’s main growth drivers and valuation to try to predict where Chipotle may be in five years.

Growth drivers

The biggest driver of a stock over the long term is typically growth. If a company is not delivering solid revenue and earnings growth, its stock price will typically flounder.

In the past, Chipotle’s biggest growth driver has been new restaurant openings, and that should continue to be the case in the next five years. The company currently has just over 3,500 locations in the U.S. While that may seem like a lot, it pales in comparison to many other quick service chains. For example, Taco Bell, owned by Yum Brands, operates 7,400 locations in the U.S., while other chains are even bigger. Subway is the largest restaurant chain in the country with more than 20,000 locations, while McDonald’s has about 13,500 locations in the U.S.

This year, Chipotle plans to open between 285 and 315 new restaurants. That equates to high-single-digit percentage growth. The company should be able to keep up that pace over the next five years.

In addition, the company is still in the nascent stages of its international expansion, with fewer than 100 locations outside of the U.S. The company has tested locations in foreign markets in the past, but those efforts have largely been afterthoughts for management.

In fact, Chipotle just decided to enter a new market for the first time in more than 10 years, partnering with franchise owner Alshaya Group for a new restaurant in Kuwait this year. By contrast, Taco Bell has more than 1,000 international locations, suggesting that this is another big untapped opportunity for Chipotle.

The other big driver of revenue growth for Chipotle has been same-store sales growth. Typically, it has achieved that through a combination of price increases and increasing traffic to its locations. The company generally increases its prices by about 2% to 3% per year, although amid the higher inflation of the past couple of years, it has been able to raise prices even more without apparent impact on its traffic growth.

In its efforts to draw in more customers, meanwhile, innovation continues to be key. To help drive traffic, Chipotle likes to use limited-time offerings such as its popular brisket option, which it recently brought back. Meanwhile, it is currently testing a honey chicken dish in select markets.

The other side of the growth equation is maintaining or increasing margins to help grow profits. In the near term, observers can expect the company to take a hit to its restaurant-level margins (the operating margins of restaurants before factoring in corporate costs), as management says it’s “retraining” staff at about 10% of its restaurants that were skimping customers on their portion sizes. However, it will look to regain those margins back by becoming more efficient.

On that front, Chipotle recently began testing prototypes of a number of automation tools to help workers in its kitchens. They include an avocado processing “cobot” (i.e., a “collaborative robot”) that can cut, core, and peel avocados, as well as an Augmented Makeline to prepare bowls and salads, which account for about 65% of the chain’s orders. While the company is still early in the testing stage with these robots, (they’re only being used at one location each), innovations like these can save money and increase speed, which will lead to better restaurant-level margins.

Where the stock will be in five years

Based on a high-single-digit percentage rate of store growth and mid-single-digit percentage growth in same-store sales annually, Chipotle could generate close to $24 billion in sales in 2030. If it can increase its operating margins to about 25% (from about 20% last quarter) through efficiency improvements and leveraging higher sales, the company would be able to generate EPS of about $3.25 (based on a 25% tax rate and 1.37 billion shares outstanding). That’s pretty close to the analysts’ consensus estimate of $3.19 in EPS for 2030, although only two analysts covering the stock currently have estimates that go out that far.

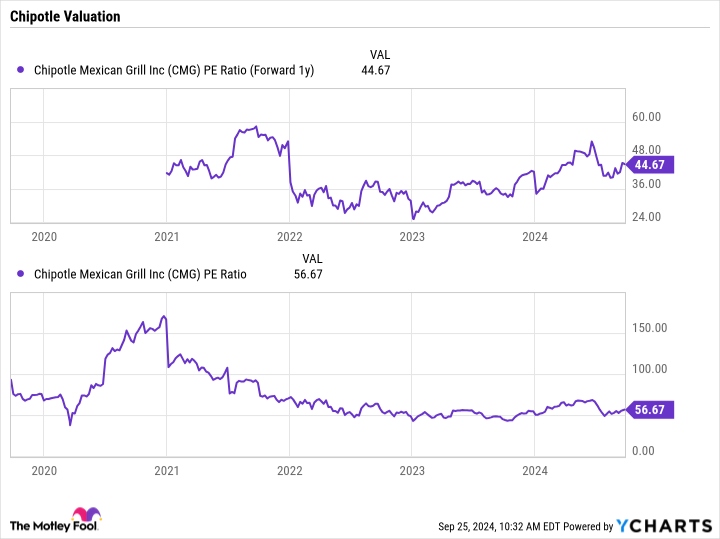

Chipotle trades now at a forward price-to-earnings (P/E) ratio of less than 45, based on analysts’ 2025 estimates. Historically, it has traded at a trailing P/E ratio of more than 50.

If you apply between P/E multiples of 40 to 60 to my 2030 projected earnings for Chipotle, that gets a forecast stock price of between $130 and $195, with a midpoint of $162.50. Even if the stock’s multiple fell closer to 30 times, the result would be a stock price of nearly $100. recently, the stock was trading in the neighborhood of $58 to $59.

All in all, a combination of sales growth, operating leverage, and increased efficiency should lift Chipotle’s stock to strong gains over the next five years.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Where Will Chipotle Stock Be in 5 Years? was originally published by The Motley Fool