It has been all sunshine and rainbows for Palantir Technologies (NYSE: PLTR) shareholders as of late. The stock is up 168% in the last 12 months and is reaching all-time highs.

Investors are excited about the company’s foray into artificial intelligence (AI) analytics, soaring revenue, and expanding profit margins. It is one of the best-performing stocks in recent memory and was just added to the S&P 500 index.

Management has an ambitious road map and has followed it brilliantly so far. Where will Palantir stock be 10 years from now? Let’s investigate further.

Analytics software for the military and big business

The beginnings of Palantir were with the military and intelligence services of the United States. The company’s idea was to build better analytics software to help these agencies and the Department of Defense achieve their various tasks with 21st century tools.

It ended up being a smart bet, with Palantir now the go-to provider for analytics and artificial intelligence (AI) software for U.S. government agencies.

These agencies have large budgets. For example, Palantir was just awarded a five-year $480 million contract from the Department of Defense’s office for AI deployment. The goal of the contract is to embed the company’s AI operating system across the entire department, making it an integral part of the lives of the thousands of people working for and serving in the U.S. armed forces.

Palantir still operates extensively with the U.S. government, but it since expanded to sign big businesses to its enterprise software tools. By pitching the fact that the top intelligence services use its software, the company made fantastic inroads with U.S. commercial customers.

In the last three years alone, it grew its commercial customer count by a multiple of nine. As spending in these long-term deals expand, this should lead to more revenue growth in the next 10 years.

Outstanding financial performance

When it went public at the end of 2020, Palantir had impressive revenue growth. That has continued up through today. Since going public, revenue is up 175% and hit $2.48 billion over the past 12 months. Last quarter, revenue grew 27% year over year.

One concern investors initially had with the company was its lack of profitability. The operating margin was close to negative 100% when it went public, driven by a lot of up-front spending and stock options.

Palantir made a miraculous turnaround in how efficiently it is run. Its operating margin was 12% over the last 12 months even as the business keeps reinvesting to expand its customer count and improve its services. This led to $292 million in operating income, a record, in the recent trailing year.

Expectations similar to 2021 and what it means

Palantir’s business is firing on all cylinders and shows no signs of slowing down. Customer count keeps growing, which should lead to even more revenue. This has investors extremely optimistic, sending shares to an all-time high of $40 in recent weeks.

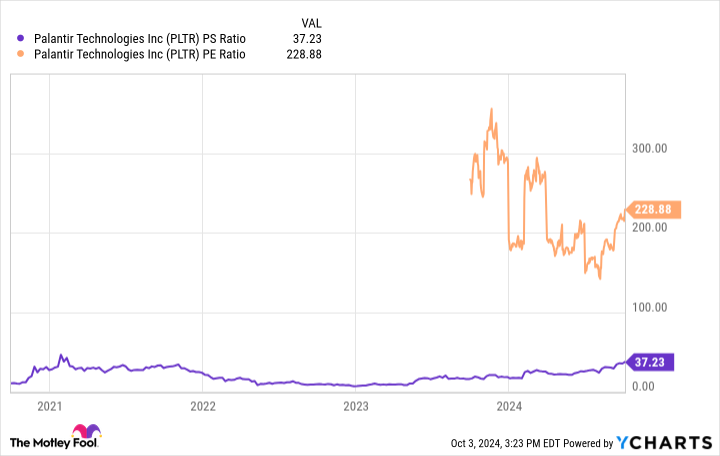

That $40 figure is where Palantir briefly traded during the bubble of 2021. Shares don’t look any cheaper today. Let’s take two easy valuation metrics as an example: the price-to-sales ratio (P/S) and the price-to-earnings ratio (P/E). Palantir has a P/S of 37 and a P/E of 229. The S&P 500 has an average P/E of 29, for reference.

Expectations are high for Palantir, almost too high versus what the business could do in the future. For example, let’s say that revenue goes from $2.49 billion to $20 billion 10 years from now and profit margins expand to 30%. That would be phenomenal performance for any business; few companies grow revenue at a double-digit rate indefinitely.

Even in this scenario, Palantir would be generating just $6 billion in annual earnings for a P/E of 14.3 in 10 years versus its current market cap of $86 billion. This is cheaper than the S&P 500 index today but not far off its long-term average.

Taking all these factors together, I think it is unlikely that shares will be higher in 10 years. I would expect them to be flat or lower even if the business keeps growing quickly. Valuation matters, and Palantir is trading at an overextended one at the moment.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Be in 10 Years? was originally published by The Motley Fool