Super Micro Computer (NASDAQ: SMCI) has been one of the hottest stocks on the market since the beginning of 2023 when the artificial intelligence (AI) revolution started gaining momentum, but the company ran into tough times of late.

More specifically, Supermicro stock delivered stunning gains of 433% since the start of 2023. However, they have retreated 51% since the beginning of March. That may seem a bit surprising at first given that Supermicro has been recording outstanding growth in its revenue and earnings thanks to the booming demand for its AI servers.

However, Supermicro has been accused by Hindenburg Research of accounting manipulation, and the server specialist’s announcement that it would be delaying its annual filing with the Securities and Exchange Commission (SEC) also added to the bearishness around the stock that has crashed significantly of late.

So, Supermicro’s uncertain outlook makes it a risky investment right now. But there’s a solid alternative in the form of Dell Technologies (NYSE: DELL) for investors looking to capitalize on the growing demand for AI servers.

Dell Technologies’ fortunes are turning around thanks to AI

Dell released fiscal 2025 second-quarter results (for the three months ended Aug. 2) on Aug. 29. The company’s top line increased by 9% year over year to $25 billion, along with a similar increase in adjusted earnings to $1.89 per share. The numbers were better than consensus estimates of $1.70 per share in earnings on $24.1 billion in revenue.

The server and computer hardware specialist’s better-than-expected results were primarily driven by the 38% year-over-year increase in its infrastructure solutions group (ISG) revenue to a record $11.6 billion. Dell’s revenue from sales of servers and networking equipment jumped an impressive 80% year over year to a record $7.7 billion.

The company sold $3.1 billion worth of AI servers last quarter. Dell also points out that it is witnessing “an increase in the number of enterprise customers buying AI solutions each quarter,” which explains why its AI server orders increased by 23% sequentially last quarter to $3.2 billion. As a result, the company ended the quarter with an AI server backlog of $3.8 billion, and management points out that its potential AI server-sales “pipeline has grown to several multiples of our backlog.”

More importantly, Dell believes that it is sitting on a huge multibillion-dollar total addressable market (TAM) for its hardware and services thanks to AI. The company estimates that its TAM could grow at a 22% annual rate through 2027 to $174 billion, up from $79 billion last year. Additionally, Dell points out that it controls 26% of the server market, which means that it is in a nice position to capitalize on the secular end-market growth opportunity.

This also explains why Dell’s outlook for the current quarter points toward an improvement in its performance in the same period last year. The company anticipates fiscal Q3 revenue to increase 10% year over year at the midpoint to $24.5 billion. For comparison, its top line was down 10% year over year in the same quarter last year.

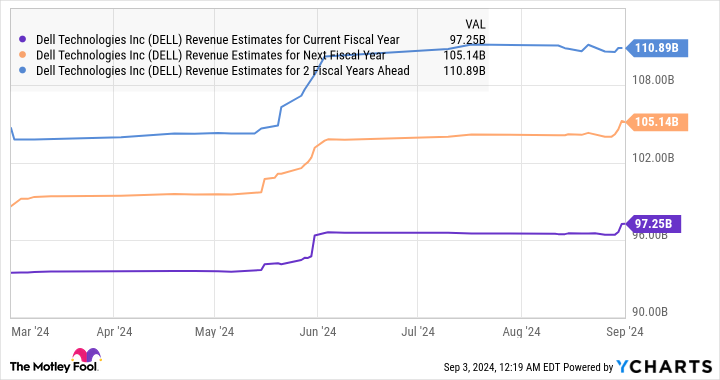

Dell is also anticipating fiscal 2025 revenue to increase 10% at the midpoint to $97 billion. That would be a big turnaround when we consider that its top line in fiscal 2024 fell by 14%, while non-GAAP earnings fell by 6% to $7.13 per share. For comparison, Dell is forecasting a 9% increase in its earnings in fiscal 2025 to $7.80 per share.

What’s more, analysts raised Dell’s revenue expectations this year thanks to its AI prospects, but there is a good chance that it may be able to grow at a faster pace thanks to its solid backlog and the long-term opportunity in the AI server market.

Strong earnings growth could lead to healthy stock upside

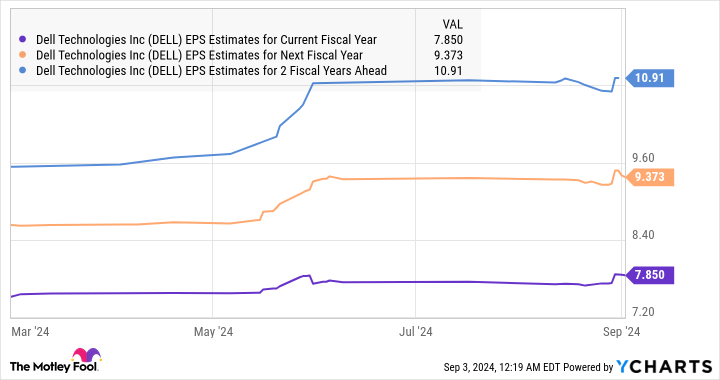

We already saw that Dell is forecasting its earnings to increase in the high-single digits this year. The good part is that its bottom-line growth is expected to switch into a higher gear from the next fiscal year.

Given the company’s valuation, investors should consider buying Dell hand over fist right away before its improved earnings power sends the stock soaring. Dell is trading at 21 times trailing earnings and 15 times forward earnings. The Nasdaq-100 index has an average price-to-earnings ratio of 31 and forward-earnings multiple of 29 (using the index as a proxy for tech stocks).

Assuming Dell’s earnings do jump to $10.91 per share after a couple of fiscal years and it continues to trade at 21 times earnings at that time, its stock price could hit $229. That would be nearly double its current stock price. However, it won’t be surprising to see Dell stock delivering stronger gains if the market decides to reward it with a richer valuation on account of its AI-fueled growth, which is why investors may want to buy this AI stock before it becomes expensive.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Worried About Super Micro Computer? Here Is a Solid Artificial Intelligence (AI) Stock to Buy Hand Over Fist Instead. was originally published by The Motley Fool